A reflective and rather long post for the bank holiday weekend.

Don’t look back in anger

I recently looked back at some stats from the start of 2007 and compared them to 2017. I’ll often compare previous periods and markets to see what I find. I’ve always archived huge amounts of data as doing so allows me to monitor my own activity, but also see how the market changes over time.

My strike rate on racing in 2007 was a healthy 80%, I won on 8/10 races. If losses were the same as profits, that strike rate on its own would be enough to be profitable. But in fact, profits were higher anyway. Wind forward to 2017 and despite the many changes that have occurred, it’s only slipped a couple of percent to 78%. I’m pleased with that.

Bad news

Now the ‘bad’ news, my individual gain per race has dropped. That sounds pretty bad, but that’s mainly down to not being able to get as much money through the market as I used to. It’s not as bad as it sounds though, my average loss is smaller as well! Therefore my net result on average comes out of the measured period at 93.4% of what I managed back then. My average amount has slipped a little, but nothing dramatic.

Of course, amounts I mentioned are average amounts. This is masked by my activity in the market. If I trade more or less, then my pound note results rise and fall in proportion. Back in 2007, I was still pushing harder and harder for bigger results and trading everything in front of me. I’m a little pickier now. I have more balance in my trading and life.

Market changes

The overall take out from this data is that average bet sizes on Betfair are falling and have almost halved according to data published on the forum. So I have to work in and around that. Basically more bets are being placed on Betfair, but for smaller amounts. If this continues to fall, you do wonder if this could be a commercial issue for Betfair at some point? The decline is not really a problem for most traders, but for an established one using larger stakes, it creates a problem.

This may also explain why the average traded range is higher than it was ten years ago. If I use stakes that are too big for the market, I may not be able to exit a position easily. So the natural response to that is to reduce the entry stake. If I don’t do that, I’ll have to take a price out to exit a trade quickly and that may cause the price to move. Multiply that by others in the market and it’s much more likely.

It seems the market is much less able to soak up big stakes now and various tests I’ve done confirm this. Increasing volume and bet size would most likely make the market more stable. But decreasing amounts seem to be having the opposite affect. You have probably seen me posting some unusual graphs from time to time and these would appear to be, partially at least, a response to declining bet size.However, every problem presents an opportunity, so whether this is an issue or not depends on how you trade or exploit this characteristic. My feel is the racing markets on Betfair now are much less likely to represent true value than they were a few years ago. In aggregate this won’t be obvious but if you are active and in the markets each day, it’s easier to see.

The introduction of cross matching on racing had quite an impact on smaller field races, so I like them a lot less than I used to. But the general structure and style aren’t that different. As I mentioned further up the average traded range has grown over the years so that has affected certain trading styles more than others. Anybody that hasn’t adjusted, has probably dropped out of the market. But as with all changes, they bring as many opportunities as they kill off. The market has also changed subtly since Betfair started pushing the sportsbook. As write this I’m thinking about many other subtle changes, too many little ones to blog. But there are a few of them for you.

Quality not quantity

One thing that has changed over time, is that I’ve figured out my results cluster in a similar way to the Pareto principle. You can trade pretty much 24×7 if you wish. But in line with my objective for more balance, I figured out that I can avoid a lot of markets and not really impact my results. There are certain markets that I know won’t generally produce favourable results so avoiding them doesn’t cost much. Sometimes entire days are like that! It’s a part payoff on investing time in other things. Therefore, over those ten years, that’s skewed my overall results towards big meetings. This is simply a factor of being able to use larger stakes at big meetings and smaller cards being less attractive for me.

If I get the right opportunity, I now have the confidence to really push things hard. I know which races are unlikely to perform so tend to skip them. Higher quality races now account for more of my overall results. Last weekend’s Grand National being a case in point.

There is a bit of risk in this. If I mess up a big race then I could impact the week. But it all tends to average out over time. It’s that delicate balance between pushing hard and too much. When I go out on my mountain bike I’m doing the same thing. I want to cycle as fast as possible, but not crash.

On a personal level

In ten years my core style hasn’t changed radically. I’ve had to tweak and refine it to account for wider traded ranges, but I’m now better at spotting the pre-cursors for key activity. There is only a finite number of patterns you will see in the market and I’ve now traded nearly 180,000 of them. So you tend to find repeating patterns. My objective now is to spot when one is about to occur and position myself for that. As I often say, for every market, there is a strategy and every strategy a market.

My understanding of all the key dynamics in the market has leapt massively in the last ten years. That’s fairly obvious because I gain more experience and data as time passes. The market inevitably gets more competitive, but I work hard to stay ahead. I’ve got much better descriptions and models of how everything works now from millisecond to hours. Of course, there is always an element of the market that is unpredictable. There isn’t much I can do about that, so I just tend to focus on what I can predict.

From a personal perspective, I now trade more sports than I would ten years ago. I’ve expanded my repertoire deeper into different sports. On reflection, I actually enjoy the research and stats sides of things as much as trading. This general curiosity has led me to figure out there is a common unity between all trading markets including sports and financials. I’ve pushed this back into financial markets, as it mainly revolves around how volatile a limited outcome event is. It was a bit of Eureka moment.

Bet Angel has changed a lot in ten years and I recently made sure it now has plenty of investment going forward for many years. I’d imagine it will continue to evolve as the markets do. Advanced automation and additional features in Guardian, such as Tennis scores & other new concepts have helped me get stuck into new areas without impinging on existing trading. I’m a lot busier than I used to be, but for the right reasons. More upgrades planned for the year.

I use Betdaq a lot more than I did, my turnover leapt threefold last year. Have a look at what happened at Cheltenham. We first introduced Betdaq Angel in 2008 and then it underwent a major upgrade again in 2011 and a few times since. In 2008 my activity was tiny, it’s substantial now. I still don’t really use that many exchanges outside of the big two as they don’t seem liquid enough. The lack of support for our Betdaq version is really curious, it has few users and nobody promotes or talks about it at all. Quite surprising for something that is completely free.

One unexpected bonus over the last ten years is that I’ve met some fantastic people. Other traders, academics, people in the sports industry, syndicates, customers, often they share various elements of those mixes. Sometimes we have similar interests, sometimes not or maybe we just have a shared interest. I have some fun stories to tell, but not just yet. As I have mentioned many times before, an open mind and attitude will open doors.

There are some unchanging things. People always told me in 2007 how hard it was and they still do today, that’s trading for you. Trading tends to be counter-intuitive to human nature. You have to work hard to get good at it and when people struggle with it the default response is to believe others can’t do it. Trading has taught me a lot about the way people think and that’s been an epiphany for me. It has allowed me to understand many things beyond trading. I’ve spent a lot of time understanding other people and participants. Directly or indirectly, psychology is an important part of any market. Explore it!

The next ten years

I’ll talk about trading in a moment, but first some life goals.

I’ve reached that point now where I’m starting to think about things I want to achieve in the next ten years or so outside of trading. I don’t want to find myself reaching 60 and thinking about what could have been. Hilariously, I’ve got hold of some actuarial tables to work out the chance of mortality or health problems over the coming years. Do it yourself, it will focus your mind when you realise how little time you have left! Somebody I knew at school died recently, not the first. So that, amongst other things, focuses your mind.

Anyhow, less morbidity. As you age and the kids mature, you realise that if you are going to trek to Everest or something as ambitious. You really need to start seriously thinking how to do it, and what it will take. I’ve already done some trekking at altitude to test myself, but if I really want to do those things, I really need to seriously work towards them now. You also start thinking about broader life goals and how you can use any knowledge and experience you gained over the years to help others. So I’ve been thinking a lot more about if I can have a broader social impact in the future. My wife already works for a charity.

There are some pragmatic issues to hand as well. If you have some working capital which achieves a high yield but no growth, eventually that capital is better deployed elsewhere. There is no point having money to hand that you can’t yield anything on. So I’ve carefully invested all excess capital and, especially in the US, that has grown much faster than sports markets. So my investments now require a lot more management that it used to. That’s likely to be more and more the case over time. Trading on sports lacks scalability, investing in financial markets generally doesn’t. Because of my interests and involvement in these markets, it’s a natural fit. This was actually what I had planned to do before Betfair came along and ‘ruined’ it!

The path

When I started doing this I wasn’t sure how long it would last. I just wanted enough to set me up nicely for something else. But suddenly it was 5 years, then 10, 15. Now I’ve no reason to think twenty years or much longer won’t be a problem. But, given all the above, it’s likely I will have to undergo a gentle shift. I love the analytics side of things, I love the cut and thrust of trading so I may never stop, but I have to think logically about the mix.

I thought perhaps the market would grow more than it has and that perhaps there would be a bigger market for services related to it. But they never reached the size I imagined. I’ve been able to automate some activity but that still suffers from the probably of scale and return on capital as discussed above. So do I just leave that smaller stuff and focus on the big events?

Well, when I started this journey everybody thought I was mad as my wife had just given birth to twins and I had a three-year-old toddler. What better time could you pick to try and make a living from gambling!

Wind forward to 2017 and I now have a 20-year-old and the twins are 16. They have grown up with Dad doing this full time and understand all the elements, disadvantages and benefits that come with it. Being technologically competent and having watched me trade constantly during their life, they are one of few that actually fully understand what is really going on. So, why shouldn’t they, even just in part, be benefactors of the same thing? It makes perfect sense.

While a Thursday evening seller on the AW may not hold much interest for me any longer. For them, the incentives are much higher and the desire will be fuelled for some time. What a great start to whatever they choose to do? I’ve actively encouraged them to explore options and take other jobs as it’s important to add some contrast. I also realise that not everybody will be a genius at trading or have a natural aptitude but as I’ve shown with my first daughter, it’s perfectly possible to show them the ropes very effectively. It’s up to them to take it higher if they wish.

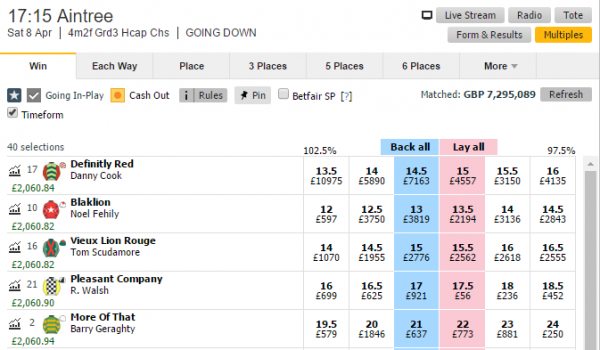

My eldest is home from University at the moment so I’ve been sitting with her on quieter days to improve her knowledge. I traded with her earlier this week: –

It seems like a neat solution to me. I can still fiddle in the market when I want, create a legacy that can be carried forward and pursue my other goals. I’ll still be trading for some time, but I’d imagine the mix will change a little and I think you will agree, that bringing the kids into the mix will keep the ball rolling in a controlled manner. Who knows where that could lead, maybe a fresh set of eyes will send it in a new direction?

Bet Angel has its own momentum now, so it’s as much my customers baby as mine now and I’ll manage it as such. The general industry and people in it need to realise that exchanges are a great model and one that could solve a lot of problems, so I’ll continue to preach that message and so should everybody using them. Everybody benefits from a growing market. Pushing high margin products that lose people money quicker, isn’t going to work long term for the industry. I suspect that eventually, blockchain technology may replace a lot of middlemen. That’s where I’d be putting my money, incumbents are unlikely to be able to do much when it arrives.

The one I have discovered is that when you have waited your whole life for an opportunity, it’s difficult to put it down. Especially when you know there is money on the table. Every market looks like an opportunity to me. To fulfil that desire, I doubt I’ll ever fully stop trading even when I reach 80!

However, I think I’ve now got a clearer idea of what I should be doing for next decade or two.

Algorithmic trader for 10 years, falling out of love with it after diminishing returns and Betfair higher rate premium charge. Your self-reflection has inspired me to dust off my idea list to see if I can get it back to a place where I’ll be proud of it for years to come.