Back in 2010, I commented during some bleak winters months, I had a dabble at Greyhound markets.

Since then I hadn’t done much work on Greyhounds as the return per day didn’t justify the effort. However, since that last post, two things may me revisit them.

The first is some renewed interest in the forum, and the second is the turnover figures I saw when I reviewed the markets at the start of the year. Bet Angel has also moved on significantly since 2010. It now has streaming and the advanced automation is at a new level, These two things didn’t even exist in 2010. So I thought it was worth another look.

Greyhound markets

The first thing you notice about the greyhound markets is they are very ‘gappy‘. This is basically what Betfair looked like in the early days. By gappy what we mean is there is a large spread between back and lay prices.

Turnover and the average return appears to be fairly unchanged since I last looked. But, of course, now it’s automated. I reckon I could yield more trading manually, but the payoff versus other sports it too small to justify that, unless there is nothing else going on.

Greyhound races are graded with open races attracting the best of breed in a similar way to a group race in horse racing. It’s no surprise then to find open races top of the turnover list. If you want to focus on where the best opportunity is, you should focus on the better quality races and particularly open races.

There are differing markets in greyhounds. The morning session is very different from the afternoon BAGS session and the evening is where you will find most activity. In contrast to other sports, there are not many races on a Saturday afternoon. Tuesday evenings tends to be the big night for Greyhound racing.

Volume

The big difference between Greyhounds and other markets is how the volume arrives. About 60% of the volume in Greyhound markets arrive in the last 60 SECONDS. Two minutes out only 20% of the money has arrived and 40% arrives in the last 30 seconds. You will need to be in and out of the markets super fast.

I was surprised to learn that SP is available on greyhounds and have experimented with using it, but with mixed results. At the end of the day trading past post time seems a little pointless as volume drops off dramatically at zero seconds.

Going forward

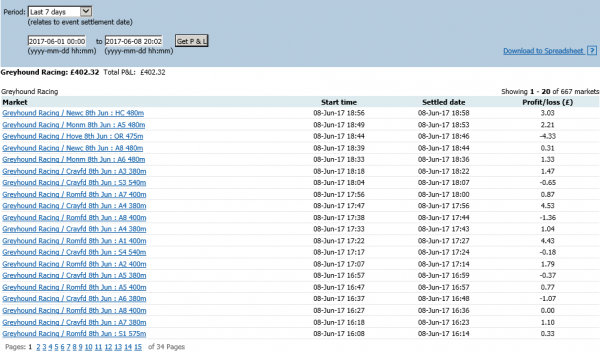

I’m still at the ‘fiddling’ stage, but I’ve have been able to match the results from 2010. The key, this time around, is that it’s completely automated. With the addition of streaming and the lack of data usage charges with the new API, it’s made this market viable again for me. I’ve delved much deeper into the market since I returned. So I’m hoping to learn more, refine what I’m doing and add this as a permanent market going forward.

Still quite a bit of fiddling to go, but it’s a decent start.