So what is the secret to profitable a betting or trading system?

It is going on a good run, getting a big profit, a long run of small profits? If you want to profit over the long term with any Betfair trading strategy. You need not only to know how to trade on Betfair, but how your full time trading is going to be profitable. That sounds obvious, you need to win more than you lose. But the reality is a little more subtle than that.

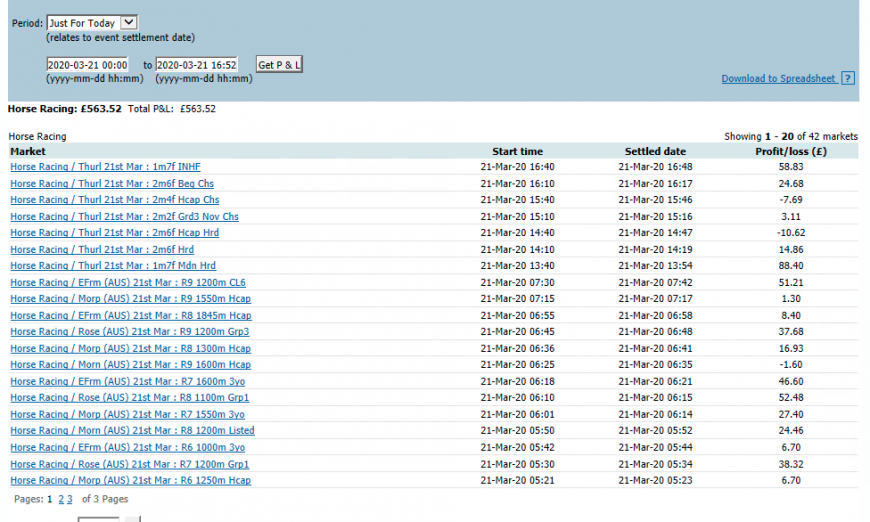

The best place to start with a profitable day trading strategy. You can see on the image below, that I’ve got positive numbers and I’ve got negative numbers. This is a trading strategy that we’re deploying here.

You can see I’m winning £6.75 when I win and I’m losing £6.14 when I lose. The problem that you have here is that £6.75 is without taking off commission, so of course, if you take a commission off of £6.75 it really lowers the value down and in fact, it lowers it so much that it’s just above the amount that we’ve actually lost. So in this particular strategy, I’m winning roughly about the same as I’m losing. It’s like I’m flipping and coin and the heads and tails are cancelling each other out.

But using the strategy I’ve gone from £0 to about £25,000. So, how do you reconcile the fact that I’ve won or lost about the same amount of money and yet the strategy has quite clearly worked and produced a very good profit overall?

To understand that, we need to look at it in a little bit more depth.

You win, you lose, it’s the payoff that you choose

When you bet or trade you will have winners and losers. You have a certain payoff with a winner and when it loses, you’ll have a certain and negative payoff. But it’s the difference between the two that generates the profit.

When you describe the pattern of behaviour of a gambler with a traditional bookmaker in a normal betting market, the best way to summarise it is that you’re taking 100% risk. You put your money down and if you don’t win you lose that – simple! The only way you can make money longer-term is if you win more when you lose, that makes perfect sense. Typically most gamblers tend to love big wins, they love to have those large odds come in. A gambler loves to put down £10 to win £100.

When I started Betfair trading, I actually started doing arbitrage betting before turning to sports trading. Betting exchanges presented a fantastic opportunity to lay for the first ever time in a sports market and I used that to back at a higher price with bookmakers and lay off the risk on an exchange.

I had to abandon arbitrage because I couldn’t scale it. If you look at the matched betting community now, it’s fairly similar – apart from using free bet offers now, rather than outright arbitrage. When you do that, you’re looking to create a position that has no risk. A gambler takes lots of risks and in matched betting you are looking to take none. You could argue that there is a bit of risk there of bookies welching on odds, or changing their mind after you place our bet.

When you’re trading you’re somewhere in between the two. Whereas the gambler likes to put down £10 to win £100, a trader will put down £100 to win £10 or sometimes maybe more. It’s all based around the level of risk that they see in a trade. You can’t eliminate risk when you’re actively trading, it’s just not possible. You have to manage it.

If you look on the left on this illustration, what you’ll see is what we’d refer to as traditional gambling. The only way that they can make money is by having that win portion much bigger than the lose portion.

When you’re trading, you’re going to be putting the same sort of stake into the market however your payoff is going to be much smaller. When you are actively trading, you’re going to have a small win percentage. But you also need to have a small loss percentage.

Where Betfair trading goes completely wrong is if you put that massive stake into the market and then you think you can get away with turning it into a bet. No, you can’t, you just cannot do that. Your pay off will be small, but your stake will be large. You’re going have to risk the same sort of money that you would do with a traditional bet, that’s the way that trading works.

If we put it into context here, a rather extreme context. On this trade we are using £50 here to back and £50 to lay, we’ve laid at a lower price than we backed it. The result of that is our £50 has earnt us £0.50. You can see that the return is a very small percentage of the original stake and when we hedge it, it shrinks even more. So basically on the £100 that we’ve put through, we’ve returned 0.25%. It’s absolutely tiny. So if you turn this into a bet and you lose that’s effectively going to cost you your entire stake, plus it will take you 200 trades to get back.

This is why when you look at the visual graphic that we’ve got here, okay you’re putting a large stake into the market but you should only ever risk movement on that stake, not the actual stake itself. Otherwise, if you end up losing that £50 it’s going to take you a huge amount of trades to get that money back.

The number one rule for profitable Betfair trading

Protect your bank, that’s the number one thing when you first start trading is that you must do, don’t lose it. If you manage your risk you’re not going to lose huge amounts, it’s going to be nicely balanced and that’s a key path to profitability.

When you’re looking at trading there are certain things that you need to be aware of:

- Profit exists in the market:

We know where the profit is, we can measure it, we know how it occurs. I can look at a market that’s going to take place tomorrow. Give me the characteristics of the market and I will tell you how much profit is going to be generated within that market. Your mission as a trader, should you choose to accept it, is to get some of that profit at the lowest possible risk. Profit exists across all of the markets you can measure. Your role as a trader is not to identify that, it’s to be able to get in there and get some of that profit at the lowest risk to your bank.

- You can’t be right 100% of the time.

You have to accept that you’re going to do some trades that are going to work really well at certain moments and some trades just aren’t going to work very well. As a consequence, it’s all about getting that balance right. To tip the odds in your favour you need to minimise the losses that you make and maximise your entry opportunities. You can also do it via a bit of money management as well and this goes back to the first image.

If you look at the middle of this image, you can see if we have a 50% strike rate we win £10. When we win and we lose £10 strike rate, there’s an equal chance of both of those happening. We’re going to lose nothing overall, we’re not going to gain anything. In fact, we may lose a little bit because we’re going to have to pay a commission on our trade so overall we would end up with a little net loss on this particular position.

How can we influence that? How can we change things? We could cut our loss if we trade with a strike rate of 50% and we can actually make our loss slightly smaller than our win then you can see overall we end up net up 50%. I’m winning £10 50% of the time. We’re losing £5 and therefore we end up with a positive expectancy.

At the other end of the scale, if you increase your strike rate then the opposite effect takes place. If you can get your strike rate up to a higher percentage then what happens is that you can actually afford to lose more than you win and you end up actually making money.

So if we go back to that image that I first showed you and that £25k, you can see that the profits and the losses are roughly in equal balance. However, you can see that we’re progressively making lots of money. So what am I doing there?

What’s happening is that my strike rate on that trade is over 50%. So when I’m winning, I’m winning that £6 more than 50% of the time. When I’m losing that £6, it’s losing less than 50% of the time. Obviously, if I’ve got a strike rate of 60%, I’m only going to be losing 40%.

I’ve got strategies that work at varying levels. When you are actively looking at a trading market, you define your strategy in different markets in different ways with different payoffs. But with each market that you participate in you are going to have to come up with a model that describes exactly what your objective is.

Depending upon what strategy you decide to put into the market, you’ll get completely different results subject to what you’re attempting to do. For each market, there will be a defined trading model that you should adhere to and metrics that you should be working aggressively to improve. But that’s how all of my strategies start.

Step by step you will improve and slowly, but surely, tip your results in your favour.

how do you approach the aus races? i can see you have traded them. may you do some videos? would be a massive help, due to fact that there is no uk races. plus u have such huge profits, i found i could not use more then £25 stakes. with the odd good liquid races. hope u can help 🙂

I can do a video on them if you wish. I note there is increased interested in them, but a lot of the ‘advice’ I’ve seen is wrong. So it needs clarity.

Are all or most of your strategies automated now Peter?

Most of your videos you do manually?

Are the strategies on the forum also.