As you may know already, my favourite market to trade on the Betfair exchange is horse racing.

I’ve been a Betfair trader on horse racing for many many years. Curiously, it wasn’t the very first market that I ever traded on Betfair. That was golf, but that was quickly added to in terms of football where I had specialist knowledge and racing actually followed a little bit later. In the early days on the betting exchange, there wasn’t a great deal of choice. But the main markets were there and I traded them. Except for horse racing.

This was because I didn’t have any specialist racing knowledge. I needed to find a way to trade racing without having a clue what on earth was going on on the racecourse.

Horse racing markets

So the time had come to look at some Betfair trading on the racing. But I would look at something like Royal Ascot and not really have a clue about anything to do with the actual racing itself. I didn’t understand the form, I didn’t understand the impact of distance on racing, I didn’t understand the nature of individual races. I really was completely clueless, so it became obvious to me that I had to find another way of actively trading the markets.

Of course, I had come from a background of trading, although curiously, that wasn’t my job. I had a job in the technology industry and trading on financial markets and investing

As a consequence, I had considered that my break from traditional corporate employment would be to trade or invest on financial markets full time. So my instinct when I first started trading horse racing on Betfair was that perhaps the best way to do this was to trade order flow.

Trading Order Flow

Order flow is the method of trading a market based purely on price activity. You try and judge what people are doing in the market you anticipate the general direction within a market and then you trade in and out based upon your understanding of exactly what is happening within the market.

Order flow is great because it allows you to participate in pretty much any market based purely upon what everybody else is doing. We all know that the market is generally efficient and therefore the markets tend to seek the price that is most efficient. The one that people are willing to back or lay at on average, or in financial markets the price at which people are willing to buy or sell.

We don’t know what that price is but we can read people’s intentions by the amount of backing or laying activity within the market. You can do the same in financial markets where you are trying to anticipate how much people are buying or selling within that particular market. That gives you a clue as to where the true price is. So when you trade order flow what you are attempting to do is to anticipate price direction based upon underlying activity within the market.

Financial markets and betting markets

In financial markets I knew you had, brokers, market makers, day traders, long term investors and a variety of different participants. In betting markets you were predominately looking at customers in the UK could be matched bettors, traditional bookmakers, or just your average

Trading order flow sounds like a really simple concept but the problem that you face when you trade order flow, y

Again in financial markets, you have limit orders, market orders, trading software, technical analysis and other tools. But when I started there wasn’t even any Betfair trading software. That’s one of the key reasons that Bet Angel was built so that I could do order flow analysis. I knew betting exchanges offered back bets, so lay bets would allow me to create a trading spread. I just needed to work out how to work inside that spread or the trend.

Betfair trading order flow – Example

Even when I started I was struggling to anticipate correctly where some of the price activity goes. But you learn some tricks along the way and then you use those tricks to understand where you feel the market should be. It’s actually quite complicated. You need to specifically understand what you need to look for on order flow and that almost relies upon breaking it down into much deeper underlying components.

You are looking for specifically within a market something that may specify that a trend is likely to continue or trend is about to reverse. That’s essentially what you’re trying to do when you’re trading order flow. Probably the best way to describe order flow correctly is to give you an example and we had a clear example this week at Kempton.

Example Betfair trade at Kempton

Every time I turn up to a market the first thing I do is casually glance over everything that’s happening within the market. I have a look at all of the runners see how they’re interacting in terms of price and if there’s any predominant trend that exists already in the market.

When I turned to this market at Kempton the first thing that caught my eye was the chart on

So it would have been very simple at this particular case in time to decide to lay early riser with the intention of trading out at a much higher price. But a casual glance across the market at other runners showed that the favourite, which had opened at decimal odds of 1.50, had actually drifted dramatically.

This was no doubt due, in some part, to the backing

It was impossible for both of these runners to drift simultaneously. Therefore it seemed sensible to put a back order in on ‘Informed front’. Now I say it was impossible for them to drift simultaneously, it’s not impossible. It was just very unlikely.

A key skill when trading order flow

Whenever you trade order flow, it’s inevitable that you will have to make judgments like this. You can never guarantee to be 100% right and that is part of the skill of trading order flow. You need the ability to be able to read the market understand what’s likely to happen but then and more importantly you have to have the guts to make a decision. You have to do something within the market.

If your assumption is wrong then you dump your trade, typically for a loss. But what happens when you get well-practised at trading order flow, is that you will find situations that you’ve seen many times before and you know instinctively what’s to do.

On this occasion it looked to me like ‘Informed front’ had drifted alarmingly and it also drifted significantly farther than you would have typically expected and therefore a back order to open the trade was the order of the day. From that point onwards we saw a sharp retracement of informed front back to what would be considered a more typical price. Within this particular market and in fact by the time the race had about started it had come all the way back to 1.50.

What happened next, you guess!

So I have a simple question for you here. What do you think happened to the price of ‘Early riser’?

Do you think the price of early riser continued to go in and get matched at lower and lower levels below

Well, the fact is by post time ‘Early riser’ had actually bottomed at 2.50. This was helpful as it was the point at which we pretty much joined the market. It had drifted out to 7.50 by post time. So just by looking at the price of the favourite and the price activity that we saw on the favourite you had correctly read what had happened to the price of ‘Early riser’.

What trade should you do?

You could have easily laid ‘Early riser’ and traded out at a higher price, or you could have backed ‘Informed front’ and traded out at a lower price on that particular runner. People tend to have a preference for either backing or laying first. In my

However, in this case, if you’ve got a favourite going off at much shorter odds, as was the case with ‘Informed front’, it makes sense to back it and trade out at a lower price. This is because your hedged value will be much higher than if you lay at a lower price and then wait for a drift before hedging your position at that particular point. This is because of the way hedging works. The final position in the market is a lay bet. Hedging a drifter costs more than hedging a steamer.

In essence, that’s what you’re doing with trading order flow. You’re looking for a key entry point within the market. There could be any number of triggers for that key entry point, but also the trade that you do could be a lot smaller than what we’ve seen in this particular market.

Betfair trading order flow – tips

You may be only looking for a small move of one or two ticks. On this particular occasion, we were looking for a much broader movement in the market, but that was only because that broader move was available to us.

So one of the key skills, when you’re actively trading order flow, is to understand the way that the market works. You need to understand the way that it generally behaves and then put yourself in the position to exploit that and trade of everything that you see for a profit. Wait for too big a move and you may see the price reverse. Trade a move that is too small and you will miss a bigger one.

But one of the key messages that I’ll send to you when you’re trading order flow is, to trade what you see, not what you think. There’s a tendency for people who attempt to trade order flow to try and justify a position that they’ve taken. Or ponder for ages waiting for the right moment. You need to be more brutal and pragmatic than that. The market will tell you what you need to know and you need to act on it.

Short term trading is all about being decisive. You need to press the button, but when you open a position you have to start looking for confirming factors. If you don’t find them then you should abandon your trade. The worst mistake that you can make when you’re trading order flow, is to get into a position and then start making up criteria that justify your current position rather than actually looking at the market and truly understanding what it’s trying to tell you that in a nutshell is the essence of trading order flow.

I’ve only touched on one simple trade here. But if you are trading on horse racing, there are many ways to successfully trade it and many things to look for. There are quite a few niches as well. I’m rare, in that I can adopt different trading styles and spot many patterns. But that’s because I’ve traded so many markets successfully over a number of years.

When you start out, it’s best to focus on one strategy and learn to sport the set up and trade it very well, before addding more weapons to your arsenal.

If you have enjoyed this article, leave a comment and I’d be happy to give some more examples.

Hi Peter,

I hope you are well? I found your article very intriguing! I’ve been following your tutorials on YouTube and via the Bet Angel academy. In recent months, I have been jumping around in terms of strategy but of late I have been trying to hone in on order flow – I particularly like the fact it is adaptable to any market when you can identify the underlying characteristics.

I would be very interested to learn of more examples or if you could point me in the direction of some good research material in terms of market behavior? So far, I can mostly find material in relation to financial markets – not coming from a financial trading background I find it quite difficult to find the relatable content.

That’s enough from me I think! Keep up the good week and excellent tutorials. When you see so many swindlers around today, it’s such a refreshing experience to learn from someone with the background such as yourself and willingness to help others along the way!

Have a nice weekend!

Thanks

Cormac

I’ll see if I can post up some more examples here. We are cataloguing a bunch of videos at the moment where you see this in effect. You should be able to view them at the http://www.betangelacademy.com

Really enjoyed that article, Peter. I wasn’t aware (until now) that hedging a drifter costs more than a steamer. Useful to me as, currently, I tend to trade drifters more. Is trading order flow the focus of your training days?

Yes, I focus a lot on this, but my knowledge in general has improved dramatically over the yeas so I’ve got lots of knowledge in specific areas, order flow being one of them.

I couldn’t help look for what causes these patterns though, so that made me look a bit deeper at the underlying sport.

Hi Peter. Interesting article. You said it was impossible or very unlikely to both runners to drift. Makes me wonder why. Do you have a video or article where I can understand this situation. My question is what would make both runners to drift. Thanks

Have a look at this video: –

https://youtu.be/bEBdGKwKrMk

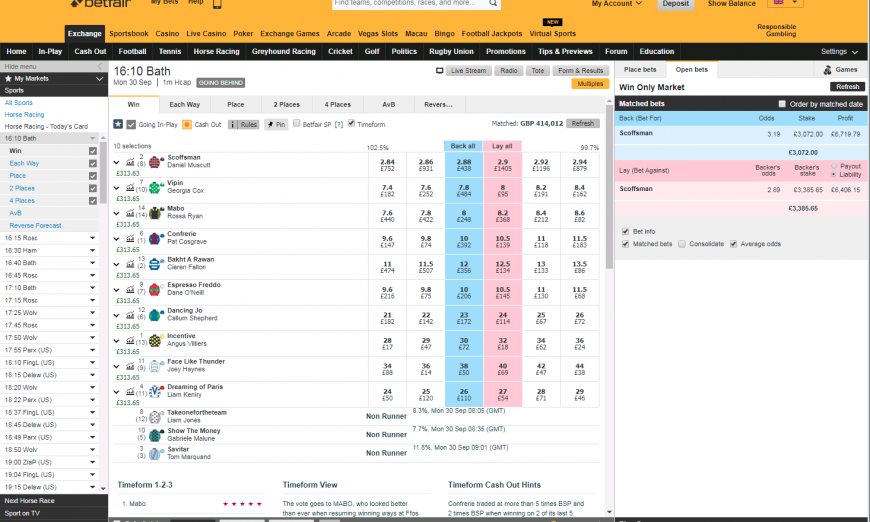

What was the reasoning behind Trading Scoffsman? Was it partly because he was a clear favourite?

Generally, yes. It’s always difficult to put things in context in an easy manner as it’s never as simple as a black and white decision. But the higher liquidity on a clear favourite will make it easy to get out if you get it wrong.

Hi Peter loved the article , I would love some more examples of trading order flow ,the more the merrier.Regards Billy

Insightful.

Never traded horses with much success, but not really much failure either. Must learn the ladders