For part one click here

The start of my new role as an ‘in-play sports trader’…

The offices behind the scenes of the high street shops

The department was massive, large TV screens covered the walls, there were rows of desks with multiple screen set-ups. It looked fantastic, I knew I had made the right decision to apply for this job, I felt a buzz just from being there.

I pictured it to be like the trading floor of a stock broker’s with everyone rushing about, shouting across the room and a bit chaotic. It was more like quiet mumblings with the occasional ‘ping’ and ‘bleep’ sound coming from trader’s computers. Quite a relaxing atmosphere really. I realised later that these sounds were alerts for football events like goals and red cards provided by 3rd party data services.

Other traders and their styles

I met with all the traders and they were a great set of guys. All with different personalities, different trading styles, but we all had one thing in common……we were all passionate about sports trading and gambling. After getting to know each trader I noticed that their personalities linked to their personal trading style.

The loud and confident individuals tended to be the risk-takers, comfortable taking big positions and expressed many opinions about the match they were trading. Large wins and large losses. On the other end of the scale, there were quiet individuals who didn’t give much away, they tended to regularly adjust prices to keep the books balanced. Avoiding having large liabilities. Slow and steady.

How we traded

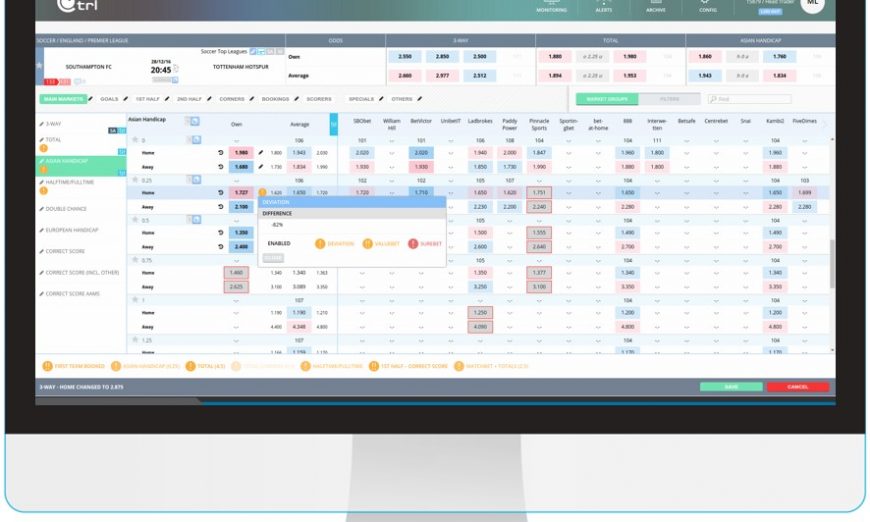

There was no right or wrong way to trade, you could develop your own style as you learnt from others. The only thing you have to bear in mind is keeping in line with the market price, in other words not putting out prices which are too far away from our competitors. It’s important not to put out any arbs, this is frowned upon by management and if this becomes apparent to management you will quickly have to explain the reasons for your prices. Unless there is a valid reason such as a competitor making a price error then you will quickly have to adjust. There’s a screen showing the bets we were laying. Move your prices away from the market and the screen will fill up with bets on your event and you can have a large liability within a couple of minutes.

The departments were split up into pre-match and in-play. I didn’t have the opportunity to meet anyone from pre-match, we were two parts of the business which were kept separate and there was little need for us to communicate with each other, just the occasional email.

Pre-match were responsible for putting the first prices on-site and would monitor their positions for much longer periods, hours, days, weeks, months etc. Depending on the event. As soon as the event goes in-play the pre-match trader’s job is done for that particular event. In my sport, I would take over as soon as the players walked out. The system would recognise every bet from that point as an In-play bet for which I was then responsible for.

My first blunder…

This is where I made my first blunder (of many!) as a trader. I was about to trade my first high-level match. There was a lot of interest from not just the punters but my colleagues as they traded their matches with one eye on the huge screen showing my match at the end of the office. As soon as the players walked out the system showed ‘In-play’, the screen showing the bets I was taking was filling up at a fairly alarming rate.

It was like I was trading the only sporting event available to bet on across the whole site! I’d like to say I quickly realised my mistake and suspended the market but I was in a state of panic and basically froze, the screen of bets was a blur. It was only after a few shouts over from a few of my colleagues to suspend that I’d realised I had put in the prices completely the wrong way round, I was offering large prices that should have been very short. Everyone and his dog got on it!

I had a huge liability but of course, I was protected by the infamous ‘palpable error rule’, but it was still highly embarrassing! I soon realised that every trader has made these mistakes at some point, it’s the nature of the job, you’re thrown in at the deep end with very little training, they expect you to make mistakes, just have to learn from them and get on with it.

Palpable error – where a bookmaker can cancel/void your bet after they have made an accidental error

This early mistake dented my confidence as did my lack of knowledge of the sport I was trading. The more experienced traders in the team liked to move the prices slightly in favour of their opinions. This means there is a bit of lee-way with regards to altering the prices, but again it’s important that you stay close to the market price.

There’s often time between the players or teams coming out and the event being played, so you normally have a bit of a position before the start. Obviously it all depends on the match/tournament you are trading, In tennis for example, if you had a Wimbledon Final you will have laid thousands in bets, an ITF match from India at 4 am in the morning and you may not even have taken a single bet.

Tennis vs. Football – live betting

Peter has touched on this before in the blog about liquidity in Tennis being directly proportional to Football, you become aware of this very quickly in this job. On Tennis, you will large numbers of money on your match when there is no particularly decent football on. If a Tennis match coincides with premier league matches at 3 pm on a Saturday afternoon for example then the liquidity in Tennis drops considerably. Considerably understandable when comparing sports markets against interest within the sport through the general public.

To understand more about the logistics and the model behind preventing consistent winners, read part three!