This is part one of a two part series.

The question over what is the best Betfair trading strategy is a question that gets thrown around a lot within the Betfair trading community and so I thought I’d create some blog posts exploring that.

So that’s what we’ve done…

…what is the best Betfair trading strategy?

Well, let’s start with the fact that there isn’t just one strategy that works beautifully across every single market you stumble across. You see, you will find each individual Betfair trading strategies all have their own little merits.

You can find little niches and places within these markets where you can deploy a strategy and it’s perfectly possible to have just one strategy and to execute against that. But you will find you will be missing opportunities elsewhere within the market, so it makes sense to really have a whole range of strategies.

When I turn up to a market, what I tend to do is assess what the market is doing and then I decide which strategy I’m going to deploy within that particular market. However, most people don’t have that luxury, as it actually takes a long time to get there. You need to practice each individual strategy and become proficient at it.

How to start finding the best Betfair trading strategy

So it’s simple: you start with a straightforward strategy.

You could start with scalping like I did, and then you can gradually progress along this path that leads you into new areas. In simple terms you are trying to solve individual market problems one by one.

The problem that you have is if you turn up to a market with the broad mindset that you are going to try and work out what this market is going to do, then that actually becomes quite hard.

So when you look at a market usually the best thing to do is if you’re starting out is to find a single strategy and look for markets in which to deploy it. If you do that, you’ll probably do just fine! You can worry about the other markets at some other point!

It’s quite a skill to be able to flip and flop strategies repeatedly within one market to be able to get the best out of the market which has taken me many years to master. I’ve had 20 years worth of practise to be able to do that!

Therefore it’s better to turn up to the market with a preordained plan, with a method, a process, a strategy that you’re looking specifically for a certain type of set up and then you can actively trade it.

All strategiesl have their merits and they all have their disadvantages. What it’s all really about in essence, is tipping the balance.

Finding that balance

Whatever strategy you do deploy, think of it as a journey. A lot of the time you will probably only win slightly more than you lose. Losses are inevitable – you have to come to terms with the fact that you are going to get losses, you’re going to make mistakes.

So it’s a delicate balance between profits and losses. It’s important to understand that is your objective, because if you set out with that objective, it makes life a lot easier because you realise that you are going to make mistakes and you are going to have losses.

This is where you are going to tip that balance between the profits and the losses. That’s your your primary objective, whatever strategy you’re using when you’re actively trading.

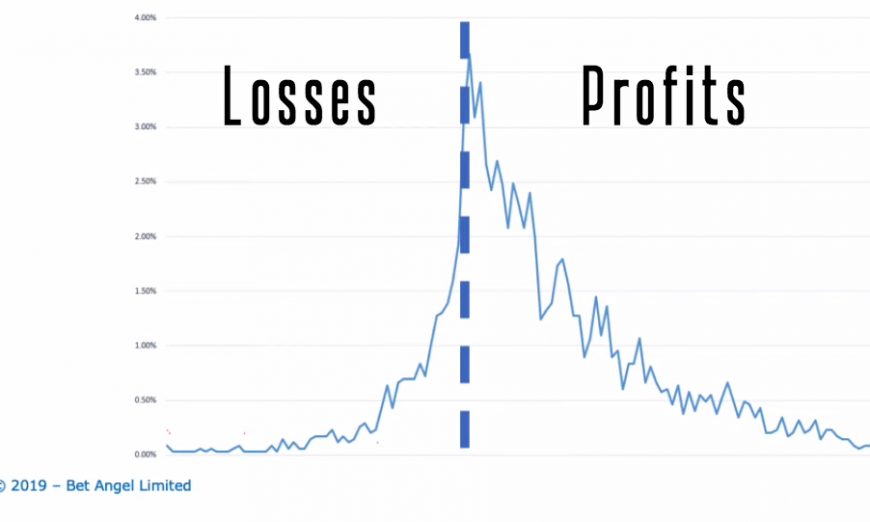

So if you look at my trading records and you look at my expectancy, what you’ll notice is that on one right side in the image above you’ve got the profits and on the left you’ve got the losses. You can see that it’s skewed towards the profit side and with experience I’m very good at minimising my losses.

This is done through a range of different strategies, but the underlying essence of what I’m doing is exactly the same. I’m just trying to minimise situations where I’m likely to make a loss and maximise any opportunities that I have to profit.

So in a way I am following a mini max theorem (for anybody that’s into game theory!) – I’m looking to minimise my maximum loss and maximise my minimum gain.

Your starting point

How to pick a strategy

If we’re looking for a strategy within the market, what is the best way to do that? What should be the starting points that you have within the market?

So let’s say it was we were talking about football, maybe you pick an under two and a half goals and you’re looking to do a trade in the first 15 minutes or the last 15 minutes.

You have to carefully define a strategy that you’re specifically going to focus on so you can progress a strategy from something that is just generic and random, to breakeven and beyond. Therefore you start looking for the setups that allow you to be able to deploy that strategy.

You don’t go into the market with the mindset that maybe it’s going to do this and therefore I’m going to do that. Pick an idea and work on rehearsing that and where to deploy that strategy.

Resist temptation!

Second on the list of your setup, is resisting temptation. You do this as it’s possible to turn up to market and you see something that you think is an opportunity and you may spot something else and then disregard the strategy you had and jump into something else.

Don’t do that!

If you want to get practised as a trader, pick one strategy and one strategy only and then look for that opportunity within the market. Once you have mastered that, you can add another string to your bow and start looking for additional opportunities that you can deploy within the market.

The problem a lot of new starters have is that a lot of them just want a shortcut. They don’t want to go through the process of understanding what they need to do to learn what they need to do and deploy it. They just want a strategy that ‘works’ or they want something specific to look for that they can just throw in a random market that will work.

The best trading strategies that create the best outcomes are the ones where you know the strategies like the back of your hand

Rehearse trade set ups

I remember somebody joining my team who wanted to learn to trade. So we sat him down and the two of us were looking exactly the same strategy and we were trying to teach him what to do. However, he seemed to really struggle to actually execute quickly when that opportunity came around as he would be waiting endlessly for confirmation.

Some of that is a confidence thing that will build over time, but the more you rehearse your trade set up, the better you will be at spotting opportunities. You’ll turn up to market and you go, I’ve seen this before and away you go.

Essentially what you’re trying to do is look for the right set up. You’re saying these are the things that I need for this trade to come off, do I see any of them in the market? So when you do see it in the market you then look for confirmation, but if you don’t see it in the market you just decide to move on.

It will be frustrating at first because you’ll miss a lot of markets. You miss a few opportunities, you make some mistakes, you’ll mess it up… But if you religiously stick to that process, then you’ll get better and better at spotting those opportunities.

Then when you can just do them with ease you can move on to the next opportunity or the next type of trade and then you can execute that one as well. You will be able to start putting them all together and with a whole mixture of strategies.

So once again. When you start, just focus on one strategy, rehearse the trade setups, look for the right set-up within the market and then practise actually doing it. Once you’ve got that sussed, you can move on to another strategy.

Summary

Finding the best Betfair trading strategy is a case of finding a strategy, practising the execution of that strategy and then applying it to the correct market. If you do these things you will be able to trade effectively because you will progressively move away from break-even by reducing losses.

In the next part of this series, we will look at how you could spot a suitable set up in the market to practice!