The question over what is the best Betfair trading strategy is a question that gets thrown around a lot within the Betfair trading community and so I thought creating a blog post exploring different strategies would be a great way to do it. So that’s what we’ve done…

For the full context, please make sure you read part one of this blog post: –

https://www.betfairtradingblog.com/best-betfair-trading-strategies/

Building a strategy: the steamer

Let’s build a simple strategy…

We’re going to build a Betfair trading strategy that will be looking to find a steamer.

Now what is a ‘steamer?’ Everybody loves a sure thing. You often see it at big meetings when there’s a jockey or a trainer that is on top form so everybody loves to focus on it and put their money on it.

Whether this happens, or whether it’s just a general market movement that takes place, you start to see this happen when a horse starts to get gambled and it just seems to self perpetuate. As a consequence, people often just back it because somebody else has backed it and because they backed it, somebody else that they backed it. So they backed it on the basis that they backed it because somebody else backed it……. and then the whole thing just spirals from there!

So this is one great strategy to start to master for beginners, here you’re looking for something that’s gradually coming in and receiving support and playing with liquidity is a great way to make money.

Settle on a strategy

Now, you could look for steamers, drifters, you could look for markets where there’s very little movement, it could be sideways… there’s so many different strategies that you can deploy!

However, by focussing on one, we’re basically looking for something that’s been backed and it looks like that trend is going to continue for a period of time. So in order for that to be true, we don’t want to see support for other runners. What do we mean by that?

Well, it’s like underground escalators – imagine we’re riding down an escalator, notice that there are people coming up in the other direction and so there two flows of traffic. That’s the way that the odds move in a market, if you’re looking at a two runner market and the odds on one are going down, the odds on the other must be going up or vice versa.

So if a tennis players playing, for example, and looks like they’re going to win, their odds will reflect that and the chance that the other player has of losing will go in the opposite direction. That’s a two way escalator. Odds work in exactly the same way as they do on this escalator.

Want to learn more about this topic? Check out these videos: 'How prices move on a ladder' and 'Predicting where prices will move'

So we’re looking for something where the favourite is being backed and we’re not seeing support for other runners. There could be other factors in play in the market as well.

Maybe there’s a jockey trainer gamble going on there or maybe something’s happened in a previous race that is somehow influencing this race. That’s all helpful in this particular case in terms of what we’re attempting to do.

Also, where is it within its current trading range? Because if you’ve got a steamer and at the top end of its trading range, then it looks like the market’s probably going against it, but if it’s at the bottom end, that’s a positive sign that maybe that trend will continue.

The traded volume and its proximity to key points within the market, like a crossover point, may help you as well. When you look at things like crossover points, they often provide a level of support or resistance for the price to go further or to perhaps head out in any one particular direction.

step 1: draw up a checklist

It’s worth coming up with a little checklist of things that you’re looking for and then if you can tick an item off of this checklist, you can start to rank the quality of your trade. So if you’ve got 10 items on your checklist and your criteria meets all 10 of those, then it’s a fantastic trade and you just dive in and get involved straight away.

However, what you’ll find with trading is it’s never quite that certain. There may be one or two things in place. So by all means, you could wait for the perfect trade, you just may have to wait a long time for it.

You’re never going to get rich by waiting for that perfect trade because they just don’t come around very often!

Typically in the summer, about once a month, I get the absolutely perfect trade where I know exactly what is going to happen and I jump on it and make a lot of money. However, that only occurs once a month in the summer.

So most other things that I see within the market are graduations of that – it’s not a ‘I’m not going to do this trade’ and it’s not a ‘this is a brilliant trade’, it’s going to be a 5/10 or a 7/10.

What I do is are very stakes according to that, so if it’s a great trade, I’ll use big stakes and if it’s a not a great trade, then I’ll pull the stakes back in because I’m less confident that it’s going to happen. So I’m trying to minimise my loss if I’m less certain I use a smaller stake and therefore my overall loss will be smaller. If I’m more certain I use a bigger stake and I’ll make more money.

Through experience, I know that those are the traits that will pay off spectacularly. So you should use all of those things, as drawing up a checklist is important because when you first start doing this as it will help you identify all of the characteristics. By the time you’ve done that, the trade has happened already and that’s very frustrating, but that’s fine!

If you can correlate what’s happened in the market to what you’ve got on your checklist, that’s brilliant, because next time you’ll probably do a little bit faster. I can take one quick look at the market and identify most of the key characteristics, but that’s because that checklist is in my brain and it’s hard wired and I will identify it very quickly.

If you’re starting out, you’re going to have to go through a little spell of trying to come to terms with that and identify and see how important each of those key characteristics are.

step 2: look for suitable markets

Then once you’ve done your checklist, you need to go off and have a look at the markets and then start trying to hunt for those opportunities, because the important thing is if you’re looking at one particular strategy, one particular style, you’re not going to find them in every market. I think the best way to demonstrate that is to go off and have a look at them within the markets.

We will go and see if we can identify a market that we think may contain a steamer.

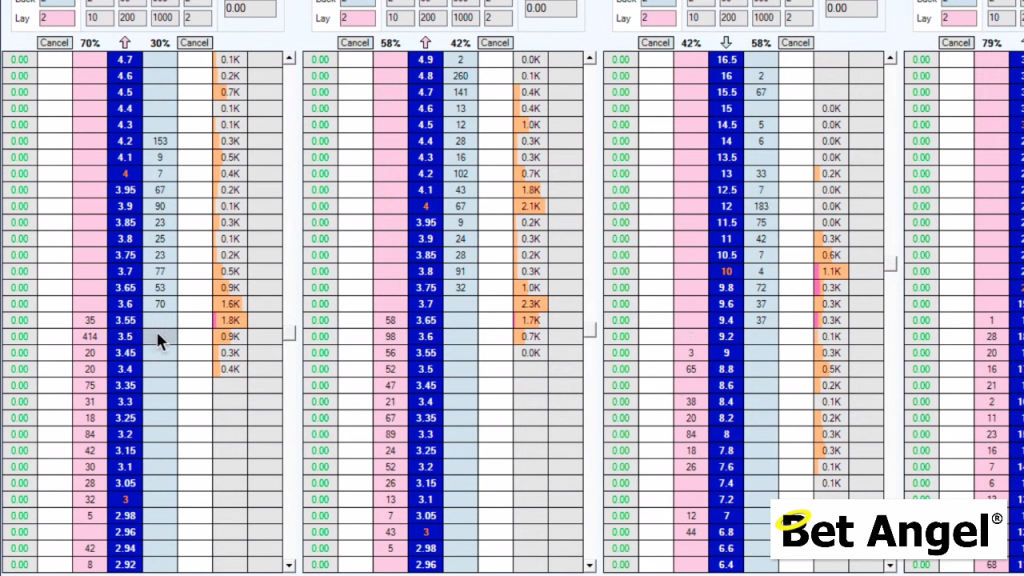

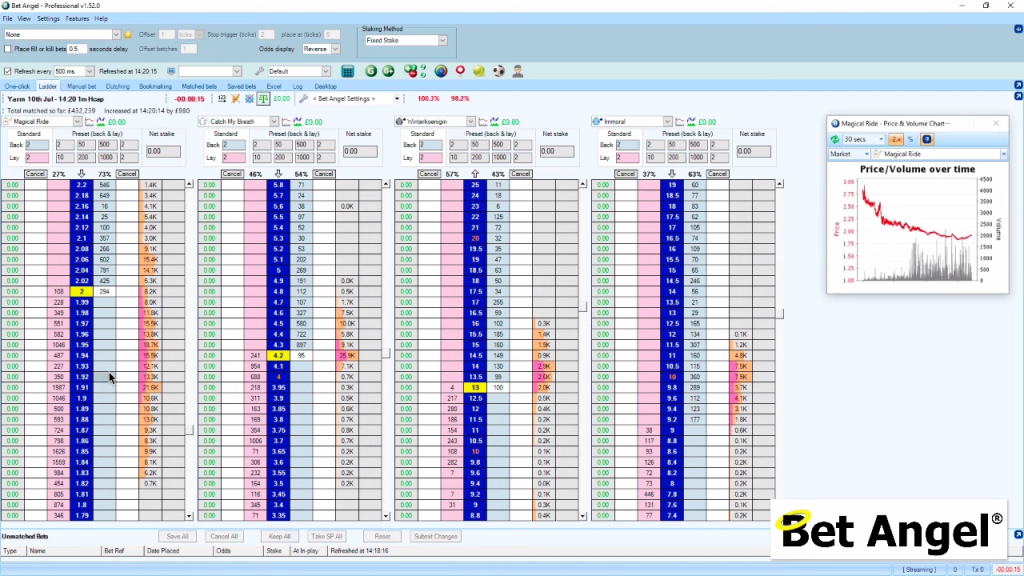

So let’s browse through the markets and see whether it conforms to the trading strategy that we had decided to follow. If we have a look at this particular market, these are some way out, but we can form a judgement on whether we think we may be interested in this.

How to examine whether the market is suitable: example one

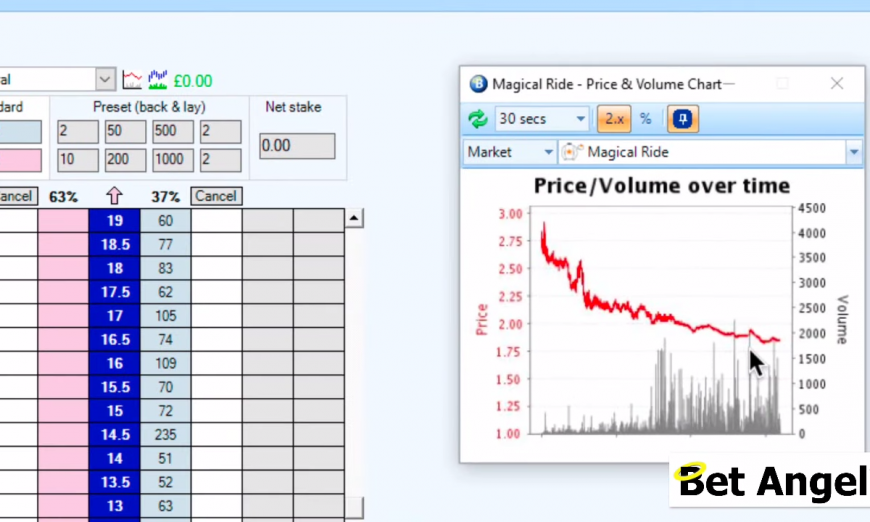

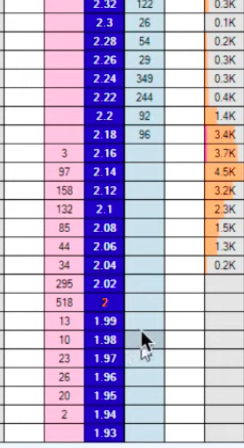

If we look at the favourite in the first race of the day, you can see it’s in the middle of the trading range. So this implies that maybe it’s stuck there and you can’t at first read too much into that.

If we have a quick look at the chart in the image above, you can see the price has drifted here and then it’s got stuck around 2.50. So you could hypothesise that 2.50 is a significant point in the market and that, in fact, it’s been on a slight drift.

However, you can see immediately if we look at the second favourite (shown in the image above in the middle ladder) that he is obviously being backed in.

So if we were deploying a strategy in this market where we wanted to back the favourites on the basis that the favourite was coming in, you need to ask yourself this question: ‘Is this the market in which this characteristic is creating the opportunity for you?’

Well in this instance you’d have to say no! The second favourite is coming in and that’s putting a bit of pressure on the favourite to go out. So therefore, this market would not be suitable for this particular strategy.

Don’t break your rules

You could at this trade and change your mind and instead go for the second, but then you’ve broken your rules immediately because you weren’t looking for that. If you keep breaking a rules like that, then you’re going to get confused because, the next market may be the third favourite is being backed in or something along those lines.

If we want the favourite to get backed in in this particular market, if we wanted to receive support, we really need to see the second favourite, which is the next highest price at the top end of its range and drifting, whereas we’re seeing absolutely, completely the opposite at the moment.

In fact, it may be that the favourite continues to drift. It’s really about whether it breaks significantly above 2.5? Now if it does and we’re seeing the second favourite coming in, then you’d probably think you’d want to lay the favourite.

So, it may actually be a nice case for laying the favourite here as opposed to backing the second favourite, but when the race starts, we’ll want to see that that backing support continues.

Ask yourself, is the second favourite pushing down towards threes and is that going to push the favourite out? If you’re looking for strategy where the favourite is being backed, you can see that this market is most definitely not it.

The way that you should approach each market is to go in with an idea of what you’re looking for and then you look for things that confirm that. You don’t go into a market and then make up a pattern of behaviour or activity that makes sense almost in hindsight.

You’re looking for things that create the conditions where your trade is going to be likely. So I’m going to skip forward on this market and we’ll have a look at some of the others and see if we can find any of those sort of characteristics.

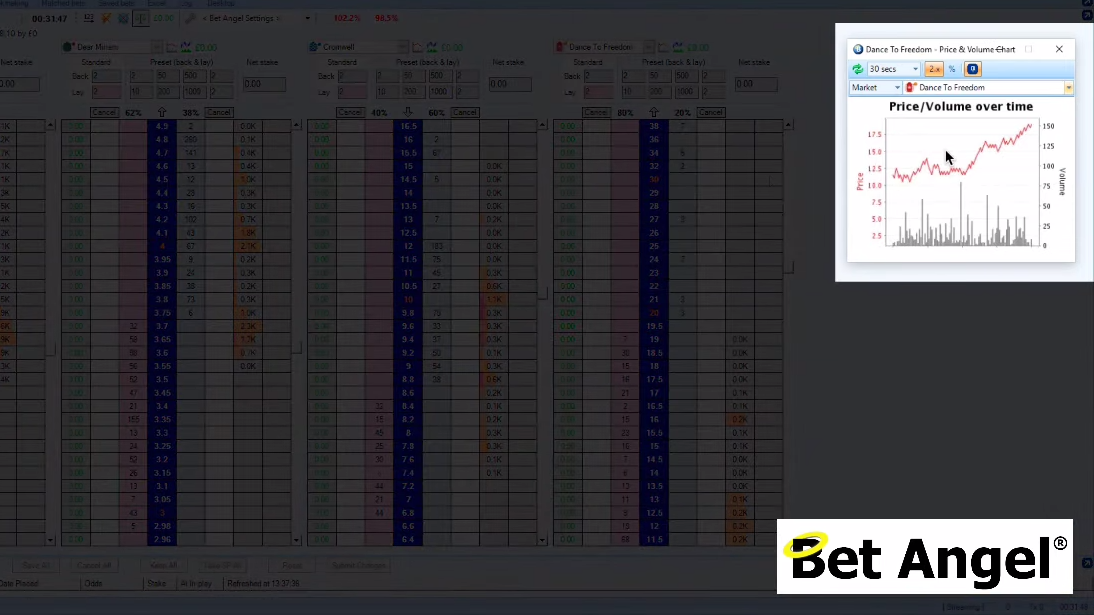

How to examine whether the market is suitable: example two

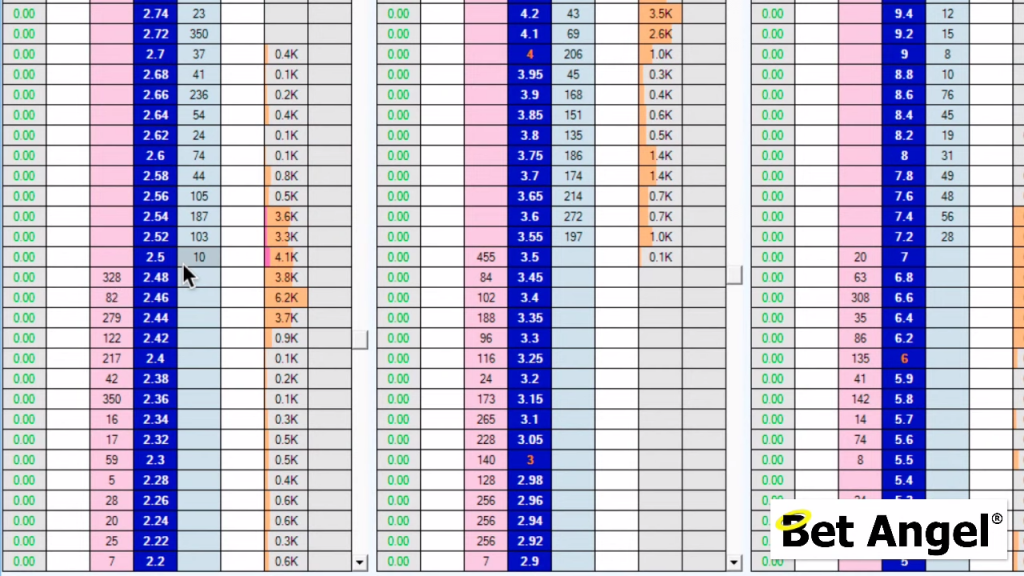

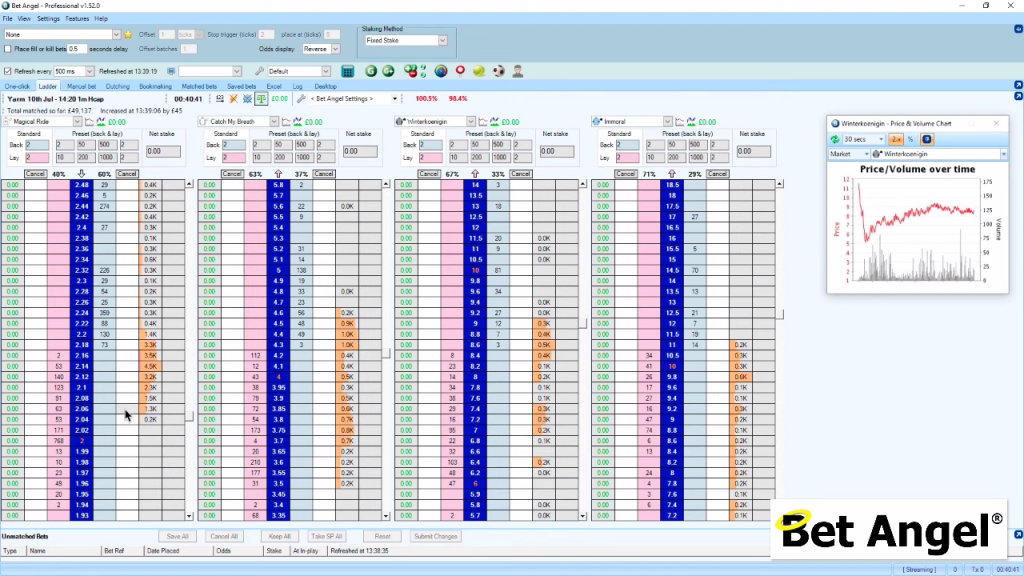

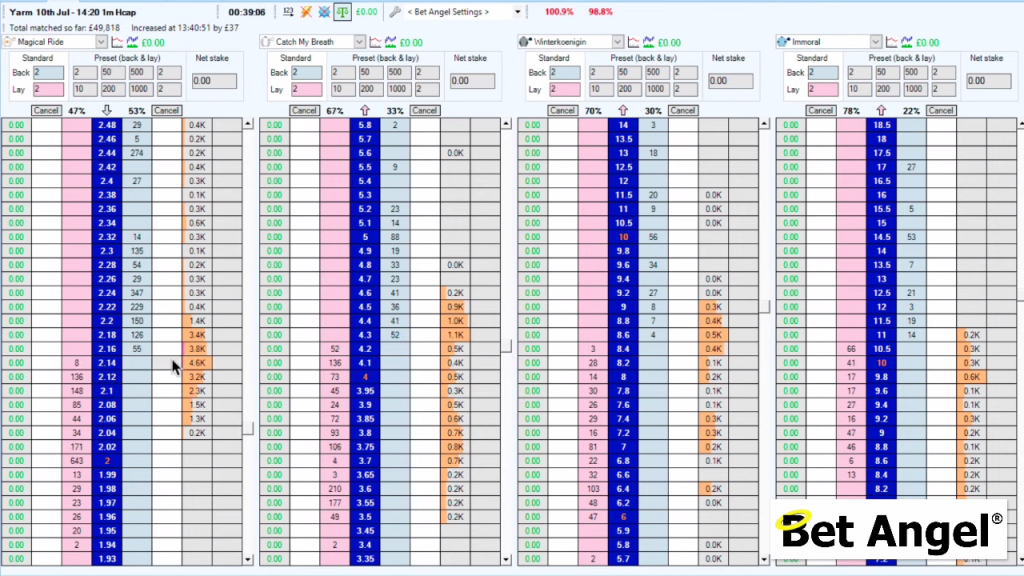

So we’re looking at the second market now and you can see here that the favourite is towards the bottom end of its current trading range.

If you wanted to see that continue, you would probably want to see a few other things at the top end of their current trading range. You can also see that the second favourite is being back as well, so there’s probably going to be a bit of a battle between these two.

The fourth favourite which is represented in the graph highlighted above has obviously been on a drift.

So the question that you have in your head for this market is which is it the favourite or the second favourite that’s going to be backed? Which one of these two is going to come in? So does that fit that criteria? No, that doesn’t really fit our criteria on this occasion either.

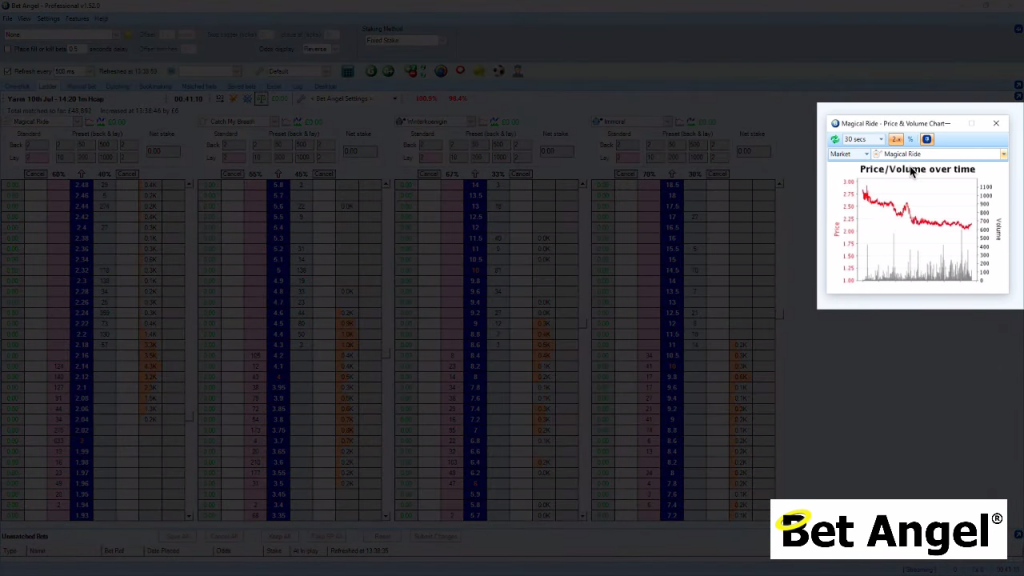

How to examine whether the market is suitable: example three

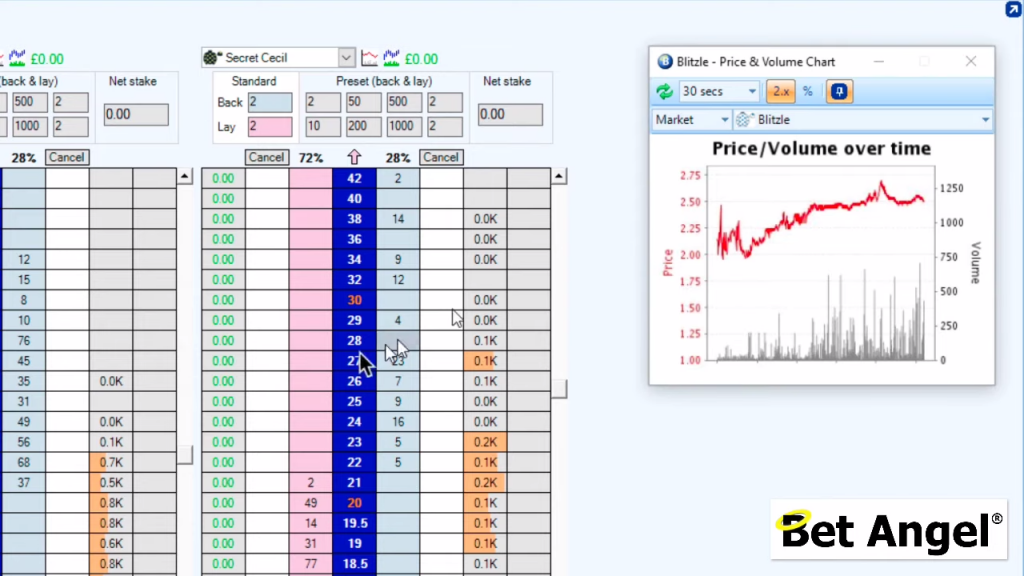

So if I skip forward to the next market you can see here that this a slightly different pattern of activity. You can see that that the favourite in this market is being backed in.

However, if we look at the second favourite, you can see that’s on a slight drift with the third favourite also following suit.

So if you compare all the ladders in the image above we’ve got three runners that are pushing out and the favourite is being backed in. So this looks like a market where potentially this trade could actually be pulled off.

If you look at where we are within the traded range there’s still a lot of money to come into as it is still early days in this market. At the moment there is only £50,000 matched so far, so when this market starts, it’ll be half a million to £700,000.

If we start to see the price on the favourite reach around 2, you can see that we’re near a crossover point within the market. So we can see we are 7 away from the crossover point at 2. So that will obviously be a critical point within the market.

If we’re looking at some of these other runners in the previous image you can see they are which far away from where the crossover point is within that particular market. As a consequence, you can imagine that there’s probably potential for these to drift and that the price just above 2 will probably get backed in, but we know that two is going to be the key point.

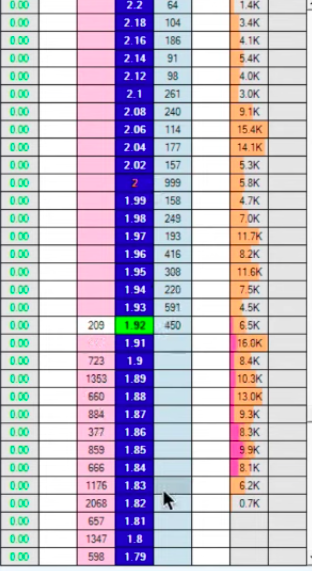

So we could back it at 2.16 and expect to see the price sort of head down towards 2. However, if it breaks two that would be pretty significant, especially if there’s volume behind it as it will stop the price from heading back in the other direction.

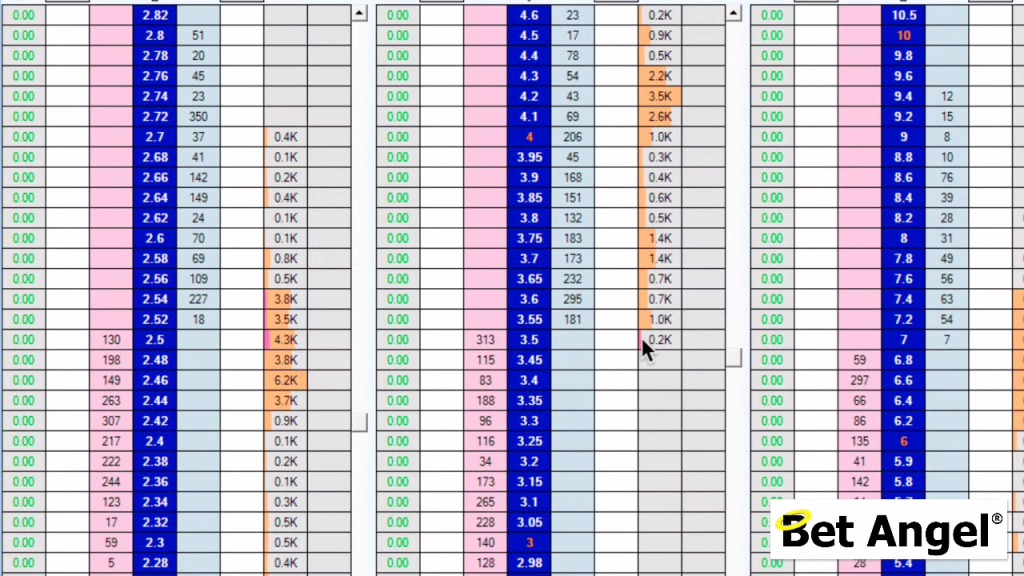

Now as we approach the start of this race, it would be an interesting race to watch and see if this pattern of behaviour continues. So when we arrive in the market, we have noted how the prices are being back above two and then it breaks at two which gives it a bit of a kick. Then knowing this, we if can compare with the other runners who can continuing drift because that will lend weight to it.

Looking back at the market we can see that we’ve got one that’s coming in and we’ve got three that are going out.

So this now looks like an interesting opportunity for you.

Doesn’t mean necessarily that it’s definitely going to happen…

However, can you see how different this opportunity is from some of the other ones that we’ve just had a look at. There is something very clearly going on within this market and when we arrive at this market, we can see if that trend is going to continue.

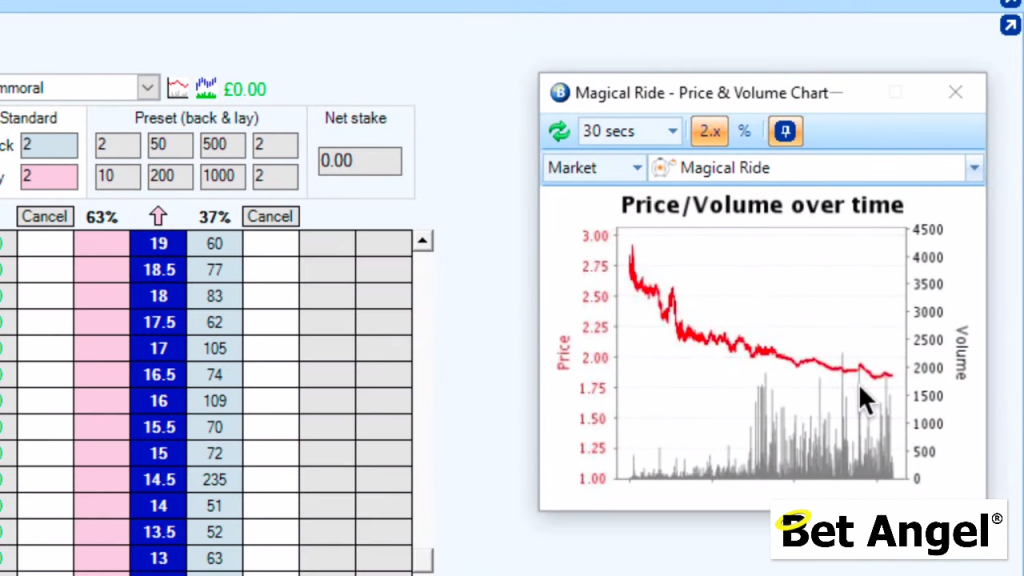

So now we look at this market at the start of this race and we’ve got about a minute left. You can see that magical ride continue to be backed in and we found it breaks around 2. We concluded that if we continue to see some support from the other runners going out or definitely not coming in, then we would expect to see the price come in.

You can see that it’s coming all the way from 2 down to the 1.80s where’s consolidating around that point. But as you’ve seen me do on a number of other trades, what you would tend to do is put your closing trades in the book much further down on the basis that they’re going to get matched at some point and you’re going for good average exit.

Therefore, you don’t wait until the optimal moment to get out. You spread your orders a bit further down the book and then go from there.

What you’re most likely to see now as we enter this little period people that have backed up much higher prices will necessarily starts to hedge. So you’ll see a little bit of volatility in the last minute and that will cause the price to meander all over the place.

So with about a minute to go, really all of your positions should have been matched or you should be looking to get out, because if it’s come in a long way, you’ll almost certainly see a rebound.

There in itself is another strategy for you!

If you turn up late to this market and you say that it’s been backed in heavily, then it’s quite likely you get a rebound just before the start of the race.

You can see above that what we were looking at earlier has completely transpired and we rebound back up to 2. Now by using our strategy we noticed that this could happen and this helped up execute a good trade.

Summary

You can see from the markets that we looked that there were a couple of markets that looked interesting and others that were not. In fact, we managed to successfully identify a steamer that we could have actively traded.

So when you’re looking to start out trading, define a strategy, figure out what you’re attempting to look for. It can be quite simplistic, as I’ve just shown and from that point on it’s all about rehearsing the strategy. then when you’ve mastered that particular strategy, you can move on to other ones and start mixing and matching all of the stuff that you see.

If you look at somebody that’s just starting out, they’ll have no idea what’s going on with the market and they may not even have any basis on which to participate. Then when you look at somebody that’s been in the market for a long time, they’ve got a whole number of cards to play, whatever the market throws at them and they will be able to instantly figure out what strategy they should deploy and put that into the market.

What you’re seeing there isn’t magic! It’s just the same thing that I’ve described in this blog post, just rehearsed tens of thousands of times…

Therefore when you turn up to market you can quickly see what the characteristics are and typically how you would trade it. Even then, you’re not going to get everyone right! So you have to come to terms with the fact of getting this balance right. Hopefully with practise you’ll get more of them, but even then you’re still going to have unusual things that happen that create losses.

Getting that balance is an important aspect of how you can successfully trade as well.

So If you want to know what the best Betfair trading strategy is, well every single strategy has its place within the market. They all have individual graduation’s within that and when you’re looking at each of those individual strategies which have a place to go within the market. Therefore you’re going to have to practise each one of those and identify those characteristics to be able to deploy them successfully.

However, what you’ll also have to do is practise relentlessly as well, so that you can make sure that when that opportunity comes around, you can spot it and you can actually do something with it!