This article is part two of two in this series. To visit part one click on this link

Premium Charge – the basics

Previously, I covered the subject and context of the Betfair premium charge. This time the focus will be on how it affected me and how it could, or could not, affect you. Read on to find out about the dilemmas I came upon with Betfair’s premium charges and how I would advise you to treat these charges. But more importantly to work out if you would ever fall into the charge.

Looking back to the early noughties, the birth of betting exchanges was truly revolutionary!

It was simple: you place a bet on the Betfair exchange and then somebody would come along and take that bet. If you won you would pay a bit of commission and if you lost, you would pay no commission at all. It was epic!

I have explained the exchange model previously, but I shall paraphrase it for you now. Imagine a big pie or a circle, on one side you have the winners and on one side you have the losers. You then have the exchange which makes its money by taking a commission from the winners.

That’s how the exchange model operated for eight years until 2008 when Betfair introduced a thing called the ‘premium charge.’ The idea was if you were a consistent winner and you met a certain range of criteria then they would be charged a certain amount per week on the amount of profit that you made.

If you hadn’t reached that amount in commission payments, then they would just top it up to that level and that charge would be taken once a week.

Controversy…

There was a huge outrage when this charge was implemented. The day that it was implemented there was nothing that I could do about it as I fell into the category that had to pay the charge. For me it was also retrospective, it was based on the activity I had already done. So there was nothing I could do to change my behaviour and reshape it to minimise the effect of the charge.

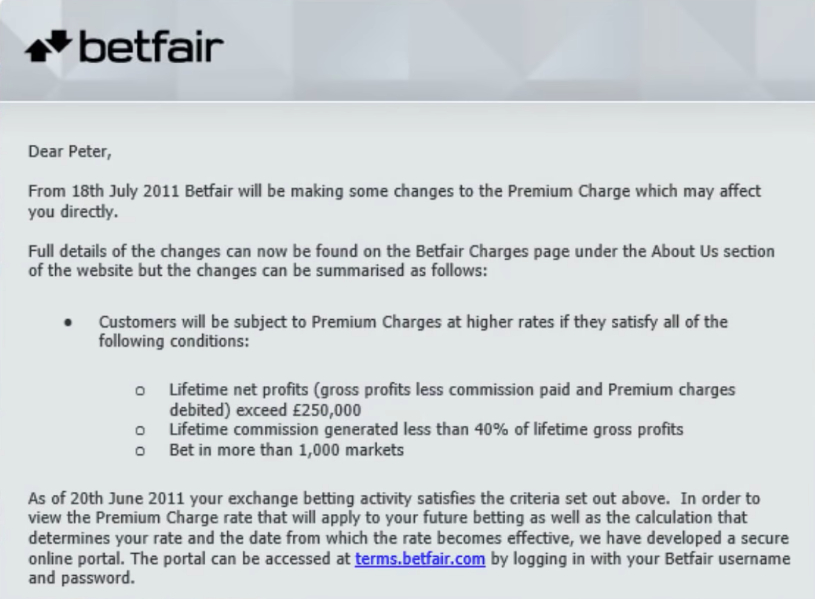

After that initial burst of outrage, it started to settle down and people understood that maybe they should be paying a little bit more, causing the tension to begin to settle. However, in 2011 Betfair introduced a higher rate premium charge which was very specifically targeted to a narrower subset of customers.

That caused a significant amount of outrage, but the big question is, is it something that you should be worried about?

That’s why I wanted to discuss the topic of premium charge to try and describe why I think the charge was put in place and how it affected me and others. One of the interesting things to note is since I first began to discuss the subject on my youtube, smarkets and matchbook have introduced a similar charge.

The initial take out from the introductions of these charges is that it’s obviously a structural issue with the way that exchanges were set up. For example, imagine if you looked at the financial market and the New York Stock Exchange goes to Warren Buffet and says: “Hey Warren you made some great picks there. Can I have some of your money?” Fundamentally that is what the premium charge does, it focuses on people who are profitable by taking some of that potential profit for betting exchanges themselves.

The positioning of the charge was that some people were winning very consistently while others were losing fairly quickly. They needed the money to be able to keep that flow of people through the ecosystem by increasing their marketing spend of the exchange. The fact that other exchanges followed suit can sort of imply that it may actually be a valid thing to do. Or a good way to drive additional revenue, you decide!

How the premium charge changed how I traded

In 2011 it was a bit of a shock to see the new level that was introduced. Worse than that I went on the absolute top rate! So what went through my mind and want actions did I take?

I did go through this spell in 2011 when the higher rate charges came in debating about what I should do. My first reaction was to start doing business elsewhere, so I started to use other exchanges more aggressively. I started doing this in 2008 but really ramped up in 2011 with the premium charge increase. As a result, my activity on other exchanges since then has been a lot more substantial which would have never happened if there was no premium charge in place.

So a silver lining to the charge, was that it allowed me to grow elsewhere on other exchanges. The unusual thing about that is when I went to the other exchanges after the higher rates came in I turned and said to them:

“Look I’m going to do what I do, if you want to come back and review it in 3 months, 6 months or whenever then we can sit down and discuss what you think of my activity. Then you can see whether you think I’m adding or subtracting from the liquidity in the exchange?”

My trading style is predominantly to offer bets to the market; I’m waiting for people to take my positions. That’s typically what I tend to do within the market, so I’ve always felt that I’m a net liquidity generator. When I went to use these other exchanges and asked if they had a problem with my prospect of asking them to watch and see what I’m up to they said “Well we can’t see why anybody would have any issue with it?”

I think this is one of the flaws that premium charge presented as it knocked out a lot of people in the market that were doing just fine. These people were simply contributors to the ecosystem! Now for me if you look at the scale of what I do there was a case for sort of saying:

“I could stop… but would you rather have a little bit less of something than absolutely nothing at all?”

I think that’s part of the gamble that Betfair and others have played, some people are dependent upon the system that is in place and therefore they have to pay their way. However, It’s important to remember the charge is still not applicable to a large number of people.

Who got caught out?

When the high rate premium charge came in there were some people that were much smaller than I, who were customers of Bet Angel and this just knocked them straight out because there was no question or any doubt that it was worth investing in continuing. The main reason for that is not the charge itself, it’s just that the fact of the charge was retrospective.

The issue that I had when the high rate charge came in in 2011 was it was based upon my entire account history to that date, 11 years of history! There is no way I can change my behaviour or unwind that criteria. It was just impossible… Other people that fell into that trap that were much smaller than me and therefore you know there wasn’t a great deal more that they could really do.

I think this was the biggest issue with the charge as it was retrospective. Additionally, the other issue that it created, is that people who were underneath the radar, or were perhaps heading up to there, had the opportunity to change their activity and therefore avoid it one way or another. People who’d been in the market for a long period of time were simply unable to do that.

So if you read between the lines, that’s why the premium charge was most likely implemented because if you look at the distribution of customers it doesn’t follow a normal distribution, maybe the numbers do, but not the amounts. When you look at the amounts of money that are won and lost in the market, what you’ll find is that there’s a big peak in the middle and then on either side of that you get winners and losers. This then tails away when you get to larger numbers but at the very end of each tail, it starts to curve up again.

So you have people that probably have an information advantage, technical advantage and knowledge advantage to an extent, there are lots of people that sit on that right far end. For example, a large syndicate that employs 100 people doing something very unusual, probably sits right on that far end and that’s predominantly what’s the premium charge was targeted at. This was simply because these syndicates generated an excess of profit consistently and it meant that necessarily they were taking a lot of money out of the system that wasn’t being reinvested put back into the system. They weren’t really contributing to the exchange.

What I learnt about the premium charge

I’ve made it my task over the many years to not just understand the market but also the participants and the business models that sit behind the markets. I think this is so valuable as it allows you to out anticipate stuff that could happen in the future or allow you to progress in certain directions.

By stunning coincidence, halfway across the world, I actually met one of the guys that was involved in the creation of the charge. That’s another story!

Out of my day to day trading life, I struck up conversations with a number of people and I began to get a better understanding of the structure of a number of people affected and why it was implemented. I constantly enjoy digging around all of the time just to find out what information I can and to see where people sit on that scale. But the fact is, at the higher rate end of the premium charge very few people actually get captured by that for a number of reasons.

The problem that I have, is by implementing an arbitrary charge, it actually captured a lot of people that really shouldn’t have been caught. As I mentioned earlier, it was retrospective so it gave you no opportunity to correct your behaviour.

Given that the higher rate charge affected such a small number of people, I always felt it would’ve been sensible for exchanges that implement something like that to talk to them individually. This is because the high rate charge was a bit of a PR disaster which continues to be a PR disaster to this day for everybody that implements it. However, nobody has really explained it in enough depth to be able to specify why it’s in place.

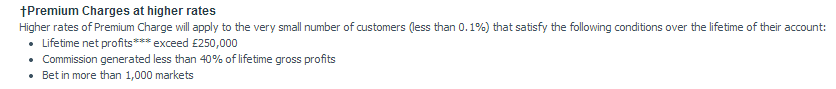

If you think about the numbers, the base set of customer that will pay the charge is on three key determinants:

- the amount of money that you’ve won.

- the number of markets that you’ve traded.

- the amount of commission you’ve paid.

If you’ve watched or read my other content on the premium charge, you’ll know that depending upon your strike rate and the type of activity that you do, you may not actually qualify for that third criteria; the amount of commission paid as a percentage of net profit. That may ensure that you actually never ever fall into this trap because of the trading style of what you do. Whether it’s betting or trading, your strike rate influences your commission paid percentage and that may never lead you into that path.

If you overcome that hurdle, then you need to overcome the number of markets traded and then the lifetime profit as well. Of course, there is other stuff thrown into the mix but I’m not going to go into great depth.

But let’s say you’ve got a 1 in 1000 chance of entering any one of those criteria, you can see that 1000³ is a very large number. If you multiply that into a user base of 4 million users you’re always going to get a very tiny number that gets affected.

So I think the way that the charge was implemented was to target that narrow strip of customers. The exchanges knew they inevitably had to throw the baby out with the bathwater and capture a few others that they didn’t intend. The problem that they were trying to solve was more or less solved by having those key barriers, which meant falling into that particular trap of having to pay much higher rate charges.

Now the lower rate charges are obviously still in place as it captures more people by making those hurdles much lower and I would imagine that there are quite a few payers of the lower rate charge. The fact that the entry criteria has not changed for a long period of time means that more and more people will get dragged into it every year that passes because of fiscal drag.

The upper limit of the amount you can win before you have to pay a higher rate premium charge is currently set at £250,000. All the discussion I see around the upper limit focuses on this number, but it’s important to note that amount your can win is actually higher than this. As the upper rate limit is NET of charges, including commission. I’m not sure I’ve seen anybody point this out. But still, to some extent, we are talking semantics as it’s still set at £250k.

In summary, the top rate was targeted towards a very narrow subset of customers. Lots of people complained about the premium charge, but not as many people as you think actually pay it. Nonetheless, it does sound good if you say that you are a higher rate premium charge payer. Proving it, somewhat trickier.

Now I am, of course, I am a higher rate of premium charge payer and have been from the day it was introduced! But that was primarily because I fell into that trap, the gap between not being an organised entity like a syndicate, but being very successful individually and also suffering from being around since the very start. That meant I met all of the criteria, so it was inevitable that I’d end up getting caught up in that mix.

My advice if you’re worried you could fall into the premium charge?

If you’re at the stage where you’re beginning your trading career and you’re worried about it, the big advantage that you have (that I don’t have!) is that it’s not going to be retrospective for you.

If you modify your behaviour now, you will still have your lifetime profit calculation and if you are successful enough you will definitely hit that hurdle. You will probably also hit the hurdle of the number of markets traded, depending upon what you’re doing.

However, the biggie is the amount of commission that you’re likely to pay and if you’re below that level or you think you’re heading towards that level where a higher rate charge will kick in then you can modify your behaviour to mitigate the effects of that.

My advice to you is if you are successful and you think that you’re heading in that direction – have a browse on the forum where others and myself in the higher rate premium charge area will be available for advice on what you need to do. They are already a few threads on the forum that discuss that process and how you can modify your behaviour to make sure that you don’t get caught in that trap.

For people like me, who were part of those paying the higher premium charge payers on day one, there was nothing we could do to avoid that trap. But part of my response to that was to go and trade elsewhere and shift my business around and modify the mix of what I do.

I think that it is a shame really because it would have been better when a charge was implemented to just wipe the slate clean and say from this point onwards this is what we’re going to do. This would have at least given people like me in my position a chance to modify our behaviours to meet the exchanges commercial objective as well as your own. I think that would have been a much more sensible way of implementing it.

Will you end up paying Premium charge?

The high rate charge is something that is out of reach for most people simply because of all of the hurdles that are required to do it and that it is specifically targeted towards a very narrow subset of customers. However, there are loads of stories of people who have been caught by it who probably shouldn’t have been…

My message to you is to remember that really it’s a nice problem to have if you’re in this situation as you got to that level in the first place and then you can start to worry about that particular situation at that particular time!

If there is one thing to take from the chatter about premium charge, its that it should be seen as a badge of honour as it is a badge that’s worn by a very few number of people! Unfortunately, a lot of people say they pay it but have never appeared on the higher rate list. Like a war medal bought at auction, it’s not something that should be worn if you don’t deserve it.

Nonetheless, if you are any customer of Betfair’s and you are wary that it will affect you, I believe it is something you probably shouldn’t be worried about in the grand scheme of things. Just keep an eye on your progress, if you suddenly become substantially profitable or if you fall into that mix, then you can seek some more advice when that time comes.

If you realise you are moving toward the threshold for the premium charge, remember you have a big advantage. You have some chance to mitigate it.

So how is my relationship with premium charge?

Obviously, I’m not a fan of this charge. I went straight onto the top rate of Premium charge when it was introduced. After a bit of foot-stomping, I reworked what I do to mitigate it’s worst impact. Despite that, I’ve still paid a higher rate charge every week for the last year. I don’t enjoy it, but you come to terms with it and also expand your ways to mitigate it and build business elsewhere.

I’ve contributed significantly to Betfair coffers over the years, but I don’t really see anything in response to that, as I’m not treated as a ‘better’ customer for doing so. Perhaps a Buggati Veyron would be an appropriate reward? Or maybe just a Christmas card? So the main message is if you are really successful, don’t expect any reward or recognition. But do expect a whopping bill.

The premium charge is not something that I enjoy paying and I’ve changed a lot of the things that I do since it was implemented, but obviously, I still do it. Partly because of need to take opportunities that are there, but also because I am lucky that the size of what I do still gives me an opportunity, even if the cost of doing it is that much higher. But like most bills, you have to treat it with a positive mindset, at least you can know it is your successes that brought you there!

Hopefully that sort of rounded off this discussion for you giving you and gave you a bit more insight into why the charge is in place. I also hope, if it is any reassurance, that you may not ever reach that level and if you do get there then you’re doing really well!

You would have my full support and congratulations on having that problem! Anyhow, I hope that gave you more insight into the premium charge and helped answer any questions you had on the topic. Despite not being a fan of it, I’ve tried to present it in a balanced format, so you can make your own decisions about the charge and why it was implemented and how you would be affected.

Hi Peter.

I am a customer of Bet Angel trading on Betfair. I am confused about what it means by 250 markets. I have already traded over 250 horse races in play since January 2022 so does this mean I have traded over 250 markets now or does it mean that you have to trade over 250 different types of markets ie some horses, some football, fhg, 02.5. Say for example for simplicitys sake I made £250,000 profit trading on over 2.5 goals and that was all I ever did does that qualify for premium charge. Nowhere have I seen a proper explanation of what 250 markets means. Its too vague. Hope thats clear. Bet Angel is great to work with. Works like lightning with a vps. Thanks Peter. Enjoying it so far.

Gordy

You will breach 250 markets quite easily if you are actively trading, so you can pretty much ignore that. It’s 250 markets in total. It’s more about reaching a lifetime profit of £250k and paying less than 10% or 5%. Those are the key barriers you need to think about.