This article continues on from another article where we introduced the concept of the Betfair trading strategy this is trading order flow.

Trading is the simple process of backing at higher prices than you lay at and netting a profit. While most people use a betting exchange to place conventional bets, profitable Betfair traders use the betting exchange much more like a stock market. When you trade on Betfair you buy and sell risk and often hedge to ensure you make a profit regardless of the outcome. This is the essence of sports trading, it’s very different from traditional sports betting.

In this article we follow on from the previous article, to look specficially at what happens in horse racing and how we trade that using order flow.

Why prices move they way they do in horse racing markets

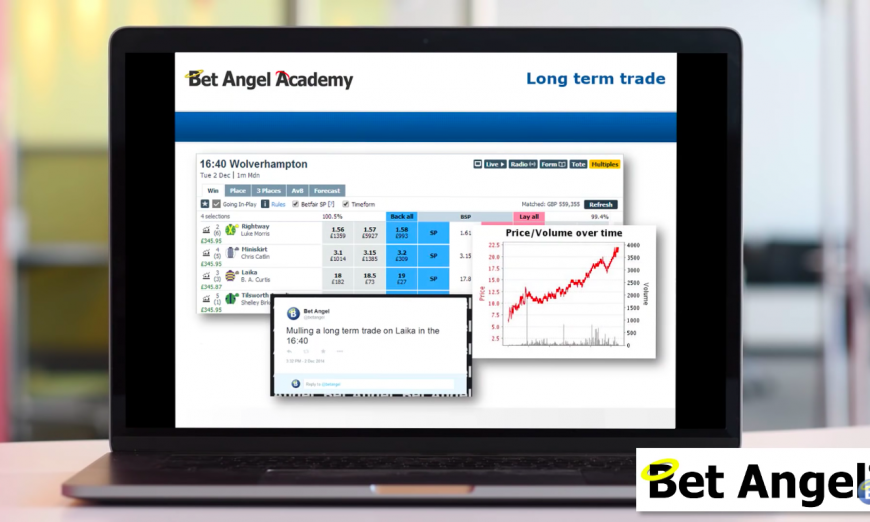

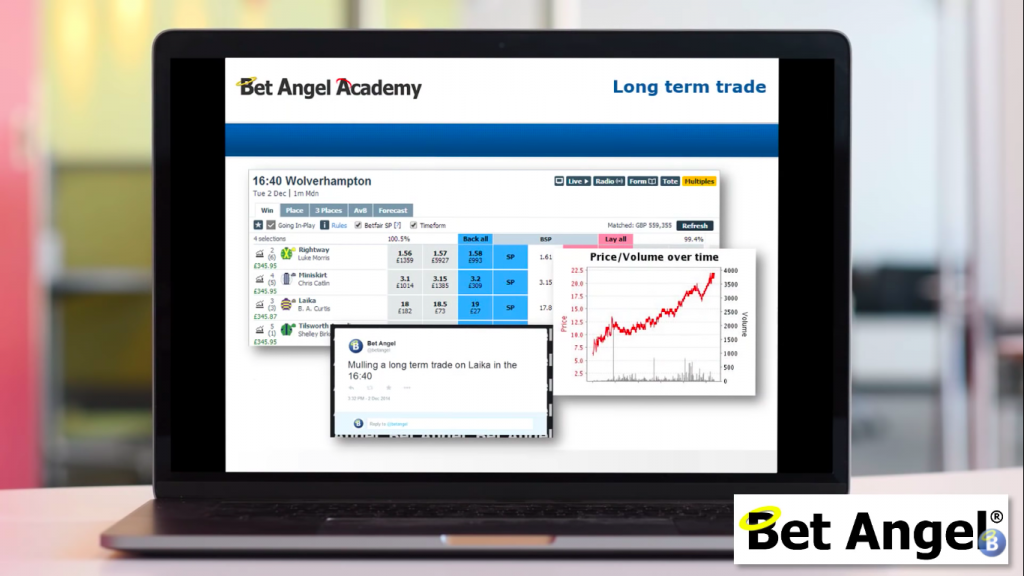

So I’m looking at a race that I’m interested in. I think it’s going to exhibit exactly some characteristics that I’ve seen before, but there’s only £14,000 traded at the moment in that market as still ‘needs’ another £700k. By needs, I mean that I know the overall matched bet turnover of this horse race will reach roughly £750k, so a large chunk of the volume is ‘missing’.

When trading order flow, you only really get to know what is going to happen when the money arrives. So as that money arrives, I will feel more confident.

If you look at a chart of volume, it’s very low, the rate of change will be the same for ages and ages, and then it accelerates in that last 5 to 10 minutes. Why?

Well, if you think about it, imagine you’re trying to bet on a one to five-shot or something at very short odds, when are you going to place your bet? Are you going to do it two or three hours before the start of the race when you haven’t even seen the horse and the ground conditions may change with the weather…? Well, you just don’t have enough information, but the closer and closer you get to the start of the race, you get more information.

You begin to see the horse being saddled up, you see how the jockey has performed over the course of the day. You can look at how other horses performed on the same ground? Then the horse moves to the parade ring and they show the horse off to the connections and the jockey and whoever else is interested.

You get another look at the horse there and then you see it go into post. So there’s more and more information coming into the market the longer you wait…

Where betting and trading crossover

Betting markets and trading markets on Betfair are somewhat different beasts. When you are betting you are normally earning a multiple of your stake. Of course, if you place a lay bet then your liability is a multiple, but you hopefully understand what I am trying to say here. When trading you are your stake shouldn’t be at risk but you will put it into the market and net small profits on it, maybe more than one.

Let us imagine you are somebody how has been given the nod on a sure thing. When are you going to place that £10,000 at odds of 1/5?

Are you going to do it three hours out when none of that information exists? Of course, you’re not! You’re going to do it at the last possible moment or when you feel confident. This may at some point in that last 15 minutes or so. People place large bets when they are confident.

So when you’re trading order flow, what you’re doing is you’re picking up on that information. There may be a reason that somebody is backing it, there may be a reason that somebody is laying it, or maybe somebody tipped it up in a newspaper somewhere.

I went off and researched all of that and looked at all of that information to try and see exactly what was happening and if it would help me. Then it just dawned on me one day that, in fact, the guy that has run a system that knows that horses that are dressed in blue and yellow and like courses that are left to right on a Thursday… he’s going to be thinking, ‘okay, now is my chance to place the bet.’

So now he has to place the bet, so why does he go? He goes into the exchange and he places the bet!

So you can see that influence on the market, somebody is confident in a horses chance or that a tipster that’s tipped something up. You can also see if connections think that the horse isn’t looking good in the parade ring , then the price will start to drift. You see all this in the betting exchange market.

You may actually be able to see that on the television as well as actually seeing it in the market. Essentially, all of those decisions get discounted into the market. So really it’s a battle than of which one is liked the most.

Order flow: trading on others opinions?

So what you see in the market when you’re trading all the flow, the aggregation of all of those guesses, all of those opinions crunched down into a number and that’s what I trade. Watching others contribute to the market and how their decisions help me know where to back and lay.

Of course, the problem is, even if you see something and have an opinion on how I think I’m going to trade, you may not be in a position to do so?

You can’t be sure until I see all of the money arriving. Inevitably, if I said ‘back this one and trade out at post time because it’s going to work really well’, then the horse would then not look good in the parade ring, the jockey would have a bad run form and then the ground would be subject to heavy from a downpour the rain starts to come down etc. Therefore, the price goes in completely the opposite direction.

So sometimes good trading is like comdey, it’s all about the timing! So when you’re trading order flow, it’s impossible to telegraph that out far into the future. Well, it’s not totally impossible, there are circumstances where everything falls into place – there is such thing as a 10/10 trade.

When those occur and you have all the information and everything lines up perfectly, you sort of want to remortgage the house, sell off the wife and kids and stick all your money on! (Now, I’m not suggesting you do that!) But those trades do occur, granted they don’t occur very frequently.

Generally, what happens on a day to day basis is there’s a bit of uncertainty floating around the market. You can never be absolutely, definitely sure, all you can do is like have an internal scorecard, which you score from 1 to 10. You know a 10 isn’t going to occur very often and neither is a 1 and you going to be somewhere on that scale.

So you can sort of say, well, it’s quite likely that this is going to happen, or I think that this is probably going to be happening and then you look for confirming factors within the market. That’s what you’re doing when you’re trading order flow. Of course if you reflect that out into the wider betting world, people just don’t get it.

People can’t understand how that’s possible. They are looking for value and form, they’re looking at specific stats on horses and jockeys and other physical things like that. Whereas what you’re doing is you’re looking at the people that are looking at the form. If you get skilled at doing that, then necessarily you’ll do pretty well because you’re just making an assessment on what’s happening in the market.

Advice I would give for beginners

What goes on in my head is probably a bit more complex than what would go in your head if you wanted to start using order flow to trade.

When I approach it I give it a broad sweep of the market across various different factors because I’ve traded over 250,000 events now. So it’s almost second nature to me. I’m looking at one thing, looking at another and I’m thinking, ‘okay, I’ve seen this pattern before so I can assume I know what’s likely to happen.’

Each time I’m only a few seconds ahead of the markets, you see someone coming in, you see it gradually weakening, then it stops coming in and starts heading back out. So I could lay that if I wanted to or I could back something else on the basis that that is going to start heading out.

These things go through my mind all of the time. You can narrow it down to quite a simple judgement. My suggestion to you when you’re starting out or you’re learning to trade, is you don’t over complicated.

If you try and do it exactly the same way that I do it, which is looking across the entire market for lots of clues, that becomes really hard because you’re going, ‘oh yeah the favourites going in, oh no it’s coming out, now I can see the big order on the third and now…’ So you just end up getting really confused. It gets really hard and it will drive you crazy.

So my suggestion to you when you’re learning to trade order flow is…

Go right back to the basic starts at a very simple base. Go into a market and you say, ‘okay, I’m going to be looking for the favourite to be backed or I’m going to be looking for the favourite to be laid.’

Then that’s all that you look for, one of those things. Not both, not across the market, but just look for evidence to support your position. If you can’t see it, don’t trade.

This way you don’t interpret what’s going on down there or up there, you don’t put up 10,000 charts and loads of fundamental and technical indicators. You just say, let’s focus on this and let’s see what I can learn like, is this being backed? If I’m looking at all of the activity, perhaps I’m looking at some charts you go back to the simple question of ‘is it being backed?’ You narrow it to that really simple process.

Now, the fact is, that you could probably go to 12 races and not see a single favourite being backed and you’ll be a bit hacked off! But what I’m trying to suggest to you here is if you learn one skill and become good at that, then you can progress.

For example, you start looking for favourites that are being laid and learn to fully understand that, then you move on to learn to start asking, is this favourite being backed or laid? Eventually, you can ask questions like, based upon what I see on the second favourite – ‘how’s that going to influence the favourite?’ and then you expand your skill set from there.

It’s OK if you have no idea what is going on

So it’s not a question of looking at the market and just saying ‘err what’s going on?’ It’s more a question (and this is how I started), of solving one problem at a time and then adding additional layers on top of that to become more skilful.

I can turn up to market within a few seconds, get a view on what I think’s going to happen and then I match that to what actually is happening. If the two of them match up, then I’ll do the trade, if neither match up, then I’ll continue looking for an opportunity. I may not actually find one and that’s fine, that’s part of trading. It’s okay to turn up to a market and say, I have no idea what’s going on!

On any one day there are a few races that I won’t touch because I don’t have an opinion on them when I first look and I don’t think you’re going to have an opinion on them in the last 5 to 10 minutes. So I always start with looking at all races, even the ones I am not too sure about, to see if there’s an opportunity. But it doesn’t mean necessarily I’ll trade it.

Sometimes not making a loss is a simple as deciding to not do something at all if you’re uncertain about it. Once again, when you’re learning to trade, this is the sort of process you have to go through. You’re looking at a market and you’re trying to understand what’s going on and if you can’t understand you’re under no obligation to trade, just wait and then a decent trade will come along.

Like I said before, if you’re just looking for the favourite to be backed and you can’t see evidence of that, skip it. Maybe it does come in, but that’s not your fault and sometimes you can’t predict these things.

In summary, just wait for an opportunity that you think you really, truly, understand and then execute against that with an appropiate trading plan.

Order flow – it’s a sprint, not a marathon

Trading order flow is odd because people very often don’t understand it. You’re not going to get a clear decision. You’re not going to have a yes do this or a no, don’t do it. It’s going to be somewhere in between.

People hate that and it makes it difficult to describe and also it unites the sceptics as well because you’ll only ever be able to show a result after it’s happened. You can’t really necessarily predict what’s going to happen, you can have a view on it, but only when that money begins to arrive will you really be able to confirm if your view is correct.

The fact is, all of that money arrives really late and therefore your opinion is going to be based upon that last 5 or 10 minutes, you’re gonna be so busy trading it, it’s difficult to actually offer up an opinion at that point. There are things that work reasonably well and some that don’t. But because of that process, you’ll find that trading order flow isn’t a yes or no decision and it’s something that’s a little bit more dynamic than that.

But for all those above reasons, that’s why it works so well as well. A lot of people can’t see it and won’t want to see it. It’s essentially the sum of all of the information within the market and that’s why trading overflow works so effectively.

I hope this gave you a better understanding of why trading order flow is so valuable and why you shouldn’t be wary of its benefits.