Punting on the Thames

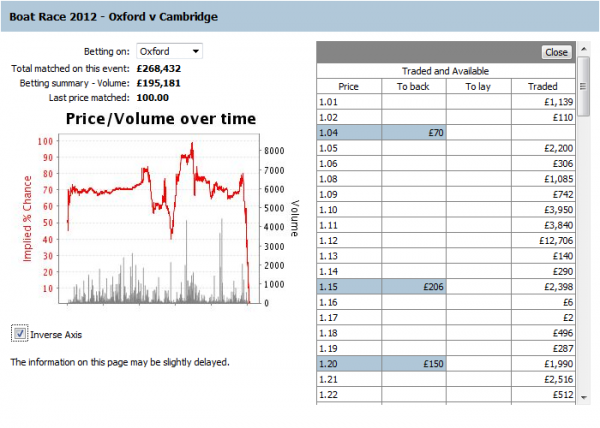

My first rule for getting involved in the market is liquidity. If there is enough liquidity in a market, it’s usually worth getting involved. So on Saturday I thought I would give the Boat Race a go.

Liquidity wasn’t great at only around £50k when I joined the market, but rose to £300k at the completion of the event. I managed to put a fair amount of money through the market but ended up with a paltry total really in the scheme of things. But certain trading strategies are ubiquitous and can work across markets, so it was interesting to see it work on the boat race. This was a bit of a test for the Olympics.

Of course the big story coming out of the boat race was the protester. It just goes to show you that, on a number of sports the unexpected, can be expected. Some sports are very well defined and clear, but others are subject to unusual happenings. I think the issue from a betting perspective is how ‘open’ events are policed. It’s probably a very timely reminder ahead of the Olympics.

From a trading perspective the confusion and the subsequent broken oar meant that both teams were available to lay at 1.01. For that reason along it will go down as a notable event on the exchanges.

![]()

Category: Alternative markets