Good days, bad days and risk management

I have good and bad trades, good and bad days but generally I don’t have bad weeks and, in fact, as time progresses my chance of a loss decreases. Why, because of the way I manage risk.

Approach to risk

The way I approach risk is pretty much the same on a trade by trade basis or on a day by day basis. One major advantage you have in sports markets, is the large number of events taking place, so I try and leverage that. As long as you have an edge, the opportunity to do something very much works in your favour as long as you manage your maximum exposure.

At the start of a day or a series of trades I consider my potential for loss to be at its highest. This is where I am fully exposed to all available risk and have no profit, yet. From here I could lose on every position I take, but that’s unlikely. But at least my maximum loss is known at this point.

Let me say I open a trade; I consider that point as my biggest exposure to the market. If we assumed I was a numbskull and couldn’t do anything above random then, in reality, this opening trade contains my worst possible loss potential. This because any profit I make on this trade can pay off a loss on this sequence of traders or other results during the day.

This relies on the fact that I don’t make things worse from that point by compounding losses, a common newbie mistake. But if we said my results were completely random then in fact I have just much upside from this point as well, it all depends how you look at it. You can see therefore that another common newbie mistake is to take a profit too quickly, thereby tipping you negative as you let your losses run but cut your profit instead. It’s soooooooooo tempting when you start out to keep taking a profit, it feels very satisfying, when in fact what you should be doing is maximising it.

Minimising losses

My attitude is if I don’t have the measure of the market and can’t make it work early on I can limit by loss by being cautious. If I things are not working the way I anticipated then I remain cautious and prod and probe until I can work a decent position into the market. I tend to limit my stakes and position until I can find a way. Often I don’t, or that primary position doesn’t complete and I’ll just cut or take the loss. Just because you want something to work, doesn’t mean it will. It could be the markets, your psychology, anything could be stopping you; but it’s best to realise that and keep things under control. I don’t chase losses, ever, for any reason.

Maximising profits

On the flip side if I get it right and I complete my position I now have a buffer against a loss and will put that back into use immediately and do it again and again. As a result, I can get things spectacularly right now and again.

Basically, I’m being cautious when I see signs that it’s not working, but will stick my foot down when it’s going well and maximise my profit. I’m sort of doing a minimax. Very often you get to the situation where you can not lose as your traded profit exceeds your stake and therefore you can afford to take on much more risk without fear of any loss. Now and again that gets you a big pay-off, one that will cover more than a few carefully managed losses.

What is feels like

I don’t set targets, for the day, week or month. I know what would be a good result, but my view is the market delivers opportunities and I have to do they best with them. Let the market be your slave, not your master.

Last Monday and this Wednesday I had those days where I just wasn’t in the zone and/or the market wasn’t playing ball. Wednesday resulted in a small profit because I just never accelerated into any positions at all and last Monday I actually made a small loss because the upside just wasn’t there. This Monday was different and it was a reasonable day. I can’t predict that, but I know that if I maximize opportunity when I see it, it will overcome any loss. I just don’t know 100% when it’s coming.

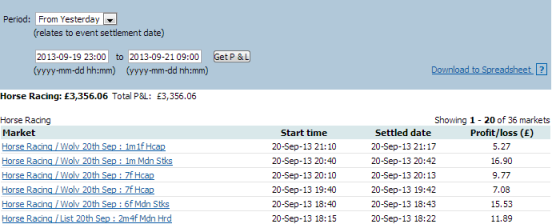

Now and again everything points in the right direction. Last Friday everything worked just beautifully so it was easy to take on more risk and push a bit harder. This can happen on a trade by trade basis or result by result basis. If I’m up heavily on the day, then I’m more likely to take on a bit more risk later on and that can achieve a big pay off. That”s what happened last Friday. This Friday has been very quiet in comparison.

In summary

So, that’s how I manage my risk in a market. If I make the wrong call I limit by loss to the very first point of entry and generally don’t expand it. If I am having a bad day it generally doesn’t get much worse, but if that first call or first market of the day is good (which is has to be at least 50% of the time) I will accelerate into it, to maximise my potential. That can be on any sport, not just racing. I just like racing because of the large traded volume and frequency of opportunity.

![]()

Category: Trading strategies