It’s always darkest before dawn

In the UK we have had a tough winter. Storm after storm, rain, flooding, unprecedented weather not witnessed for 250 years. But it will end and this is where the title on this blog post comes from.

We all know that day follows night and vice versa, but in a period of time relative to yourself, sometimes it seems there will be no end. But I can assure you that everything in life works in cycles.

Remember 2013? Only last year, in fact less than a year ago. Everybody was telling us to conserve water and get ready to face more drought restrictions. What does this have to do with trading? Extrapolation.

The problem with the human mind is we like to see patterns, we want to take something that has just happened and push that out to the future. The trouble is risk doesn’t work like that, it’s more a wobbly path between extremes. I don’t tend to follow trends, I try and anticipate them. I’d happily bet on a decent summer at the moment. Best time to do that, when it never seems like it’s going to stop raining.

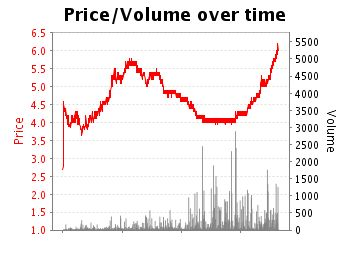

It’s possible for humans to see order in disorder, but where money is involved people end up attributing random fluctuations to fact and end up following the crowd. In my experience this leads people to push any underlying value to extremes.

I first learned this in financial markets and with that knowledge in hand, I brought that to sports markets to test. It turned out it was true here as well. People see a line, draw a bigger one and follow it. I feel uncomfortable with that and when I see a trend develop I realise I have missed it already. Better to be in near the start. For me, unless I see clear reasons to contradict my thought process, the longer a trend persists in a sports market, the less likely it is to hold or develop into a profitable position.

The stock market is similar, it’s the only market I defiantly know where people sell things as they get cheaper and buy them when they are expensive. But the overall trend in sports markets is similar. As the price on something contracts it tends to be poorer value, as it expands, better value. I made good money in both markets going against the crowd.

In 2008 when everybody was heading for the exit on financial markets I was sweeping around the floor looking for opportunities. It’s a tactic that has paid off in the past and paid of handsomely in 2008.

These value opportunities appear to persist not from statistical bias, but from a psychological bias. The reason? Spotting and exploiting these inefficiencies is a simple process, but one that is not easy to execute. As Buffett once said, it’s like telling people you married your wife because she was ugly!

So, in summary, that is why these opportunities will probably permanently persist. People find it incredibly hard to bet against the crowd. It’s human nature, whatever the underlying subject.

![]()

Category: Trading strategies