Manual or automated?

It was with interest this week that somebody pointed me to a blog post debating, or should I say justifying a stance on automated trading vs manual trading. Here is my angle on it: –

Financial markets

If you look to financial markets you have many aspects to it. High-frequency traders, slamming in positions in and out of the market to scrape a few cents per trade in as large a block as they can get through. A very specialist area. Long only funds, long and short hedge funds, derivative funds, fundamentals investors, short-term traders, day traders etc. etc. etc. you get the picture. Each one of them has a place in the market.

I have friends that run two very divergent hedge funds. One chap has a broker with which he discusses the positions he wants to take and tasks the broker with filling them. I guess he could be described as manual and the other chap using complex algorithms to trade options and sometimes the underlying asset. He is looking for market pricing errors and zips in to correct them. Both make money, both co-exist perfectly.

I have money invested in both, as they are both very good at what they do. Both happily exist in the same market.

Sports markets

Sports markets are no different. They are very diverse, you have bookies, punters, traders, arbers, HFT’s and a variety of differing participants. If the market gets out of kilter arbers move in. If traders push a price into value, punters move in. You get the picture.

Manual

Sports are unique in that a number of metrics unfold real time and are often unrelated to what you see directly in the market. There is a direct cause and effect in sports that isn’t similar to financials (in most respects). There often isn’t a direct measure of the metric that is about to move the price. This is still very much the domain of the manual trader. There are a number of manual only set-ups that occur with remarkable regularity, there were a few clear cut ones today and some less obvious ones. But you may be interested to know that manual trading is and always has been the source of most of my profits.

Mid afternoon I spotted something unusual and sat and waited for confirmation. Sure enough, it came, so when it happened again I was sat there waiting for it. At around the same time, something different happened and repeated so I jumped on that as well. Most of the other markets were fairly predictable within the models I have created over time and I traded them, manually, as appropriate. The exceptions to the rule meant I modified my normal behaviour quickly to take advantage of what I say.

Automated

Of course, I’m out for every opportunity I can get, so that’s why I pursued and we developed Bet Angel with that in mind. From modelling pricing tools for individual sports, to the ability to easily fully automate a strategy.

When these anomalies occurred today I quickly shifted my trading style, but I also switched off my automation or modified it. It would have happily carried on without a problem. But given the shift I saw, I felt the risk on the automation had just gone up a notch. So I intervened to tone it down.

Automation can operate in areas that I just can’t; mainly speed related. So it fills that gap nicely and can add accretive amounts to my trading account 🙂 Never repeat the mistake I made years ago by assuming that something couldn’t be done or there was no logic to it. I look a fool now on comments I made around 20 years ago. But I had the humility to accept I was wrong and learn from it. Many people don’t, belligerently sticking to a discredited viewpoint. This would appear to be another form of loss aversion! One thing I’ve learnt is to have an open mind and be prepared to challenge myself and convention. Time and time again it pays off and it will continue to do so in the future.

Conclusion

Manual or automated trading can work and can happily co-exist in the market. They tend to work to different objectives and exploit different things. Automation is great for zipping in and out of something quickly but often can’t see a bigger picture and that’s where trading manually reaches its forte. Momentum shifts and changing underlying conditions, that can’t be picked up automatically, can be easily detected by that marvel of nature, the human brain. Even then there are some wonderful trades you can do and predict. All you need to do is keep an eye out for them and act decisvely when it happens.

Often the best strategy, if you have the bandwidth, is to do both and get the best of both worlds. That’s what I tend to do. I trade manually on Betfair and Betdaq and also run automated strategies in parallel. I suggest you run automated strategies all the time, even if it is just to collect data for modelling or to get a better understanding of the market.

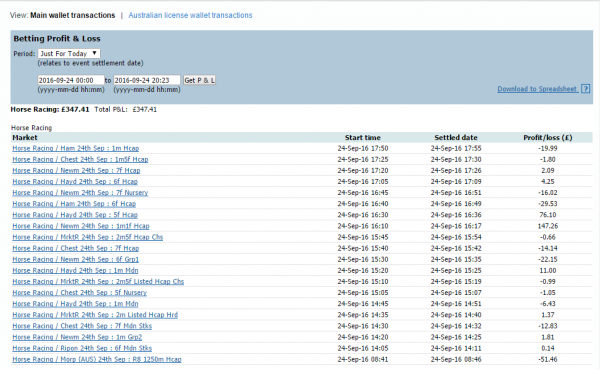

For evidence of both, have a look at my results from today. The top is manual, where I am deciding when to enter or exit, the second automated. The latter had a rough time today, but I’ve learnt over time that having an element of control often produces better results. Without my guiding hand today it probably would have performed worse. Or was it just a case that my trading eye just generally produces better results? With automation, it’s often a payoff between the time you spend shepherding it or eliminating potential errors, versus the time and quality of life you get by not having to be in attendance. That can be a very personal decision.

I tend to enjoy the fun of the chase, so I’d imagine both will continue to be a feature of my trading for many years to come. In my opinion,. both have a place in your trading arsenal.

![]()

Category: Featured, Trading strategies