Betfair test new pricing models

Betfair announced their FY2013 post close trading update today and generally put a positive slant on things. True detail was hard to come by though.

The S word got a lot of mentions today but it was a confusing picture, for me at least. They showed big growth in the sportsbook customer base, but didn’t indicate whether it included the Blue Square stuff or not? So it’s difficult to know if that figure has any relevance. Also last year the sports book was hidden whereas its very visible this year, so again, difficult to compare.

You can view the full presentation here – https://corporate.betfair.com/~/media/Files/B/Betfair-V2/pdf/Betfair-7-May-13-presentation.pdf

There was very little mention of the exchange business, despite it being the main contributor to Betfair. I’ve been analysing company reports and presentations for years, so I’m often more interested in what not was said. That gives you a hint at what’s up beneath the veneer. How I wish I was sat behind one of those analysts asking questions! Just a little surprised at how little was said about the exchange model given it’s significance. Nice slide on page 21 of how there is an overlap of sportsbook and exchange customers, but caveat inserted that it is UK only football customers with no further split available. So very little to be learnt on that.

But, the two most interesting aspects of the presentation where: –

(1) Betfair seems to want to keep the sportsbook and exchange together as one proposition.

I think they are better off split TBH. They appeal to very different markets and I think it’s confusing and misleading a lot of the time. I’m pretty sure if you focus on the different metrics in both models the sum of all parts would be bigger and better. Sure you can cross fertilise to suit and for added benefit, but they are very different models. Over the long term that will become apparant again I suggest.

Betfair mentioned they will link both concepts so sportsbook mugs, sorry – punters, can cash out using the exchange. It seems there are several angles they are looking at for integrating the sportsbook and exchange, which should benefit layers on the exchange. Interesting.

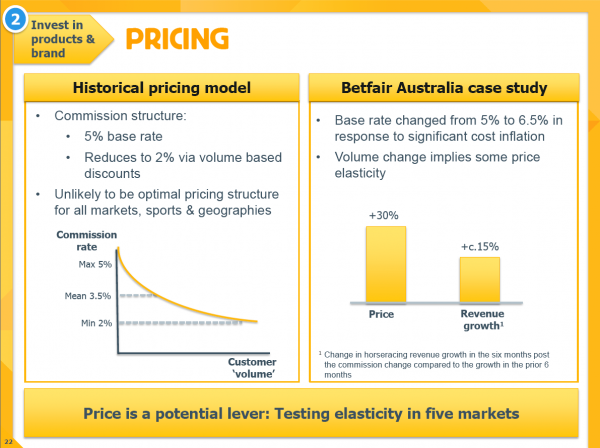

(2) Betfair confirmed they are trialling new pricing strategies

Spotted already by the Bet Angel community was the fact that several territories have seen price hikes recently. During the presentation on page 22 there is a confirmation by Betfair that this is a deliberate policy to test price elasticity. They have picked five markets and have raised prices by varying degrees in four markets and lowered them in one. Breon wouldn’t be drawn on the what’s and ifs of this policy and seemed to stress that prices rises where not a formality, but judging by past behaviour I wouldn’t be hopeful of the next price move being downwards.

The quoted example is how they were forced to increase prices on the Australian markets but that turnover went up. I’d mark that down as an exceptional case I think given the circumstances, but Betfair have taken this as a cue that prices can be raised elsewhere without affecting their business. One confusing situation on the Australian side of things is how trading was effectively outlawed by the change in legislation, but didn’t affect turnover?

Anyhow, the presentation didn’t have enough detail to make an real judgements or comments but did have some interesting snippets in it. Take from it what you will.

![]()

Category: Betfair