Tag: liquidity

There is Light at the End of the Tunnel!

We are now in the middle of February which is historically the poorest and hardest trading month of the year on the pre-race horse racing markets, typically there will only be around £450m traded this month which is around 40% less than the amounts expected as we hit peak season where the monthly volume will of increased to around £750m.

How does this effect thing from a trading perspective?

When trading any market liquidity is key none more so than …

Loadsamoney

I made a post on social media this week about an article that appeared in the Financial Times. I didn’t realise at the time of posting, that in the background there was a mention of a sizeable position then went through the market at Royal Ascot.

I only realised this, when people started questioning it shortly after the post. Asking how it was possible put £125k through a market?

Ordinary or extraordinary?

This wasn’t an ordinary market, though, this was …

Volume is not liquidity

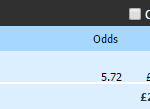

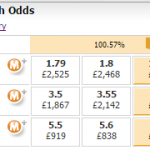

I was at a meeting last week and was at pains to point out the difference between volume and liquidity. I’ll save the detail for another post at some point in the future, but here is a simple view and some examples, using just £100 stakes.

If you come on any of the courses we run, I’m happy to talk you through the strategy. It’s simple easy and really effective at tournaments like Euro 2016.

Stuffed full of cash…

Ladbrokes WILL feed bets to Betdaq to boost liquidity

Discussion on the Ladbrokes exchange is the hot topic at the moment. How will it look, how will it work etc. etc?

Today we received official confirmation that Ladbrokes on-line clients, who are being teased with a ‘coming soon’ tab on their home page, will feed liquidity directly into BETDAQ. Visiting BETDAQ’s home page today saw them send a clear message on the benefits of the Ladbrokes integration to all users. I’ve reproduced the graphic for you on the blog.…

Derby post mortem

An interesting Derby meeting this year. I don’t often post up analysis after the event but I thought it was worth a few notes this year.

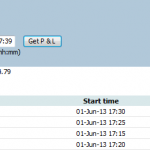

I managed to pull a decent result out of the hat on Saturday, but I think I’d describe it as exactly that, ‘Out of the hat’. It was a bit of an erratic today, where I ended up with quite a bumpy P&L.

For some reason UK racing thought that putting on lots of …

My curious liquidity poll

I recently asked on the bl0g poll, top right of the blog in case you hadn’t noticed, about what constitutes ‘good’ liquidity in a market. I think there are quite a few considerations you could take account of when assessing what ‘good’ liquidity is. But it was sparked by another poll which asked ‘What would make you move to Betdaq’. The answer came back ‘better liquidity’.

We are all aware of the chicken and egg syndrome that exists in the …

Connect

Connect with us on the following social media platforms.