So you might have heard this phrase before, only the bookmaker wins!

But how does a bookmaker make money and how would you price a market like a bookmaker? Whether it’s horse racing, football, tennis or betting on sports in general, they always win, so what is the secret?

Betting exchanges offer near-perfect books, that’s a feature of exchange. So while this isn’t really applicable to a betting exchange, it’s worth examing so that you can fully understand the concept and how that influences prices on the Betfair exchange.

Step one : Create a betting market

The reason that you would need to do this, is because you’re going to lay odds into that market that people will bet against.

You create the market ☞ You create the odds ☞ Then they will bet against you.

So let’s take a really simple example of creating a set of odds and for that, we’re going to use a coin. If I toss a coin, barring any oddities, the coin will end up on heads 50% of the time and tails 50% of the time. So there’s a 50/50 chance that it’s going to end up head or tails.

How do we price that in a set of odds? What we’re going to do here is use decimal odds because that’s how the exchanges are priced.

Well we know that there’s a 50/50 chance (0.5 in decimals) of that coin being heads or tails.

So if we do:

1 ➗ 0.5 we get 2.

Bingo – we have a market!

So let’s say that the market for heads is 2 and the market for tails is also 2. The way to assess how efficient and how good a market is from a betting perspective is to do the opposite calculation.

If you see a market priced at odds of 2.00, if you do 1 ➗ 2 , then we get 0.5. Therefore, if we had a market with two runners in it, priced at odds of 2.00 on the exchange. If we add both it equals 1 or a 100% chance that either of those selections is going to on to is going to win this particular market.

In the case of our coin toss, what’s actually going to happen is that we have a 100% chance of the coin being head or tails as they are both priced at 2.00. Knowing these terms, there’s no margin lost to either side of the book.

The backers can back something with a 100% chance and the layer in this case, the bookmaker who’s making the market in the book, can lay into the market at odds of 2 for 100%. He’s not making any money either.

So that’s a perfect market, there’s no margin on either side!

Step two : Creating your own odds

If you were a bookmaker one of the things that I would want to do, is to make money from the backers. So if we were looking at our coin toss market and I go into this market and offer odds of 2 on a head or 2 on a tail, then basically I’m never going to make any money.

Over the long term we would expect heads and tails to equal out and I’m going to pay out 100% of my money for 100% probability.

So, in fact, there’s no advantage in me doing that. I could convince you that the chance of a head occurring on the next toss is high because we’ve had five heads in a row beforehand. Obviously, that’s complete rubbish, but I could convince you that was the case and therefore, I’m only going to offer you odds of 1.50.

What happens if I offer you odds of 1.50?

What am I actually offering you when I’m offering odds of 1.50? Well, if we go and do that little bit of maths again, we do 1 ➗ 1.50 it comes out at 0.66666 occurring. In other words, what I’m more or less saying is that it’s got a 67% chance of occurring.

That’s nonsense because a coin has a 50% chance of being a heads or tails. So if I offer you odds of 1.50, there’s absolutely no reason that you would choose to take those odds, because I’m offering you odds of 66% chance of something occurring when it’s only got a 50% chance. It just makes absolutely no sense whatsoever!

People do this all of the time in betting markets, however. They will back something despite the fact that the odds just don’t stack up. So when you’re backing in a betting market, you want to get the highest odds that you possibly can. Then when you’re saying you want to get the lowest possible odds to that, because doing either of those two things is how you make money in the long term on a betting market.

If we went into a market and we could back heads or tails at 1.5, we would lose money hand over fist to the person that’s pricing that market. However, if we go into the market and back heads or tails at odds of 3, then we could effectively buy the chance of the coin being heads or tails for a 66% chance, giving us 30 odd percent margin.

If we back it at 1.5, the margin goes in the other direction and it’s actually the layer that has the margin within that particular market. So when you look at a market and you see the odds, that’s effectively telling you the chance that something is likely to occur. The layers want you to take the lowest odds possible, but as a backer, you want to be able to take the highest odds possible.

Understanding how a bookmaker works

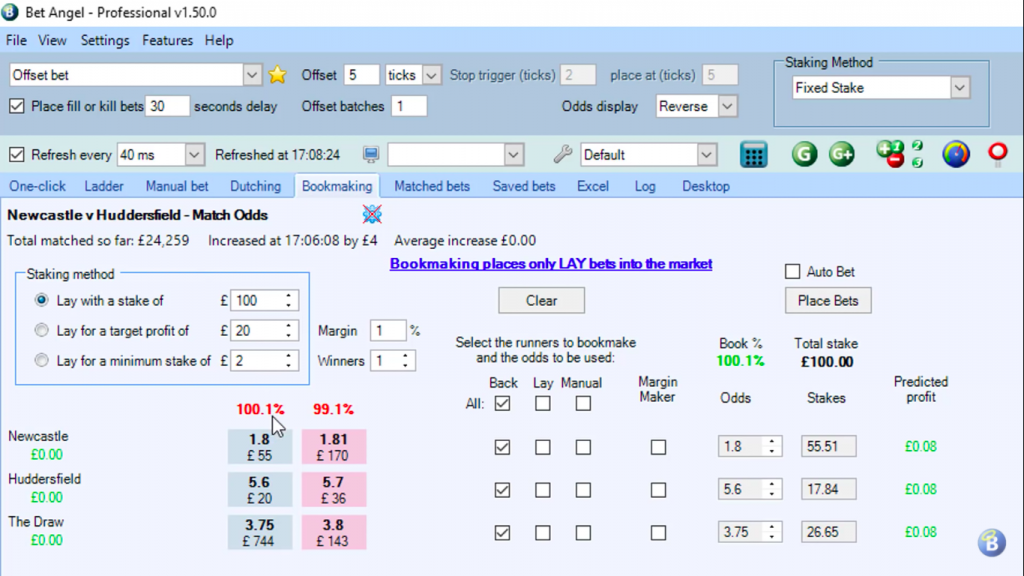

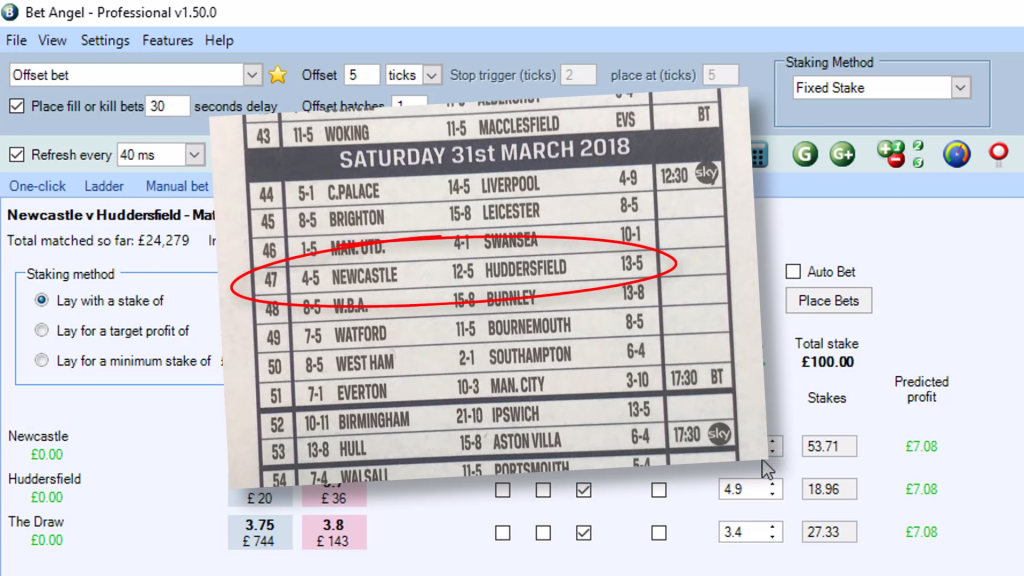

Let me show you a practical example of this, I’ve chosen for this example a Newcastle v Huddersfield market. You can see above that the market is super efficient here and that it’s priced at 100.1. That means if you’re backing into this market, you’re only losing 0.1% to the other side of the book which would have traditionally been a bookmaker.

However in this market, the layers on the other side of the market and you can see in the image above that it’s super efficient, there’s almost no edge to a layer in this particular market at these particular odds. So if I was a bookmaker, that would obviously be completely unacceptable to me.

The betting exchange market is so hyper efficient, you will never find a bookmaker that can offer these odds, as they coulnd’t possibly make money in the longer term with a margin of 0.1% There are many problems to doing this on the exchange. You can’t balance your book, you can’t be sure bets will arrive in proportion and you can’t adjust prices to encourage a balanced market.

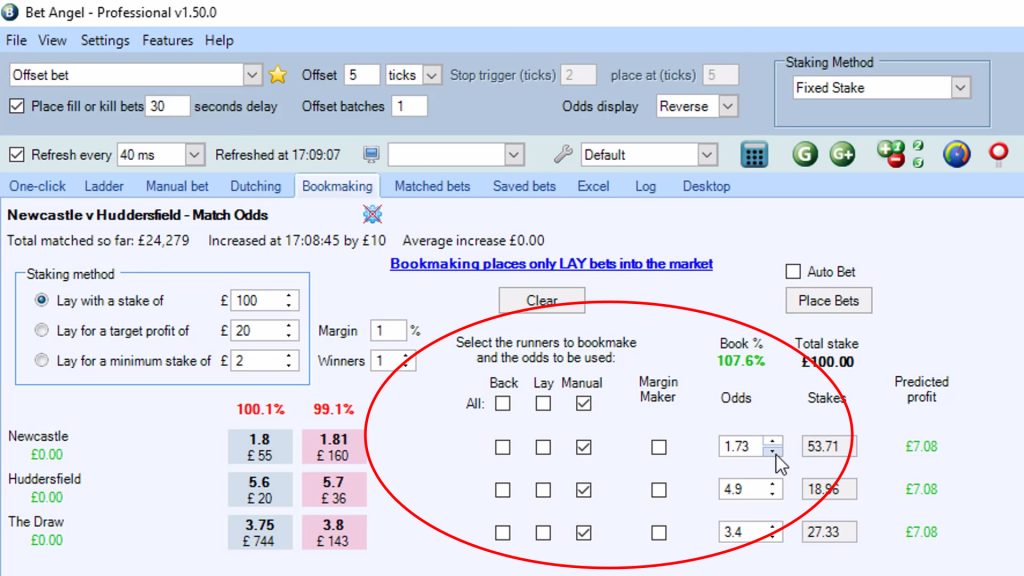

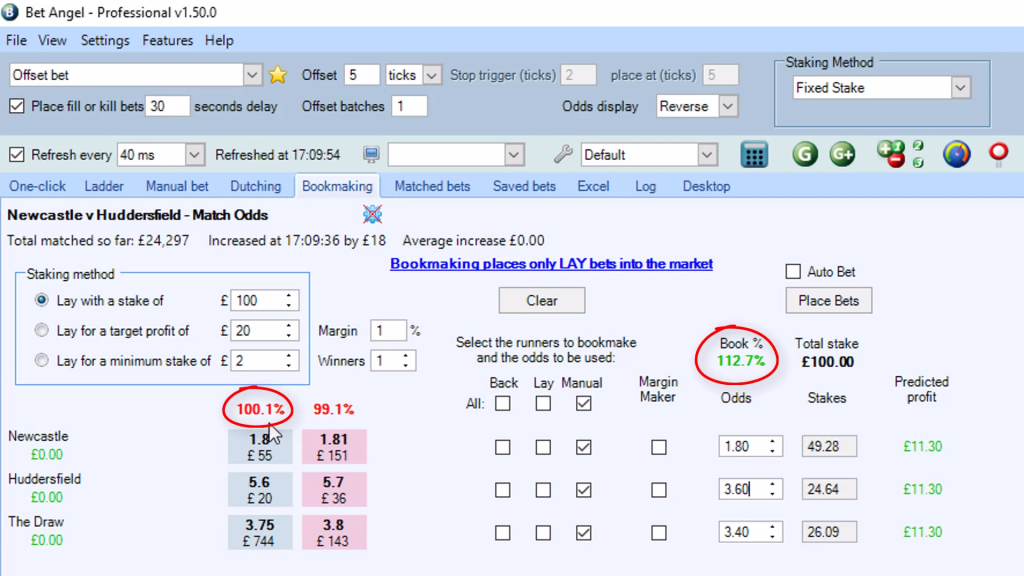

In a conventional market, the best way of creating margin is to change the pricing, so if I change from back all to manual on the bookmaking tab on Bet Angel, I can actually reduce the price on each one of these.

You can see the percentage starts to rise and that’s how a bookmker would make margin on this particular game.

If you want to cross-check this, get some bookmaker odds and have a play around with this feature in Bet Angel. What I did was I nipped out and went to my local high street bookmaker to find out what else they were offering within this particular market. Of course, you could go to an online bookmaker, but a conventional bookmaker will probably need higher margins.

According to the odds that I picked up on the coupon, they were offering 4 to 5 on Newcastle, which in decimal odds is 1.8.

On the draw they were offering 12 to 5, which is decimal odds of 3.40 and on Huddersfield they were offering 13 to 5, which is decimals of 3.6. So can you see that slight difference between the margin (circled on the right on the image below) that you lose at the bookmaker and the amount that you lose on the exchange (circled on the left in the image below.)

You can see here that if you bet on the exchange, you almost lose nothing to the other side of the book because you’ve got a very competitive market. However, if we went into a local bookmaker and placed a bet there, you can see that they’re asking for nearly 13% theoretical margin on this particular game.

Now we can actually give them credit, they are fairly competitive on Newcastle so it’s not a ridiculous proposition on Newcastle. You can suspect that probably believe that the exchange is full of smart money and they probably have that price right, but it’s undoubted that these prices will change as we head into the weekend and the market adjusts for new information.

In comparison you can see that pretty uncompetitive on the remaining selections and very uncompetitive when we go for the away win. So there’s absolutely no way that you would back an away win here, but maybe you would be able to get a decent price at the bookmaker if you were backing just Newcastle.

Summary

What you have read here is a practical example of how a bookmaker prices their margin into the market.

Bookmakers essentially make money by pricing a market at different odds to the likihood that underlying event happening. This means you can’t win in the long term as you are betting or something that simply can not happen or at odds that do not accurately reflect the chance of it happening.

If you use a betting exchange to bet, then the odds tend to be very close to the real chances of that event happening and very little money is lost to the the other side of the book whether you choose to back or lay. This makes finding value much more likely on a betting exhange as opposode to a traditional bookmaker or sportsbook.

The fact the market is almost perfect, amongts other things, means it also impossible for conventional bookmakers to operate on an exchange. It’s just your judgement against others.

Knowing how a bookmaker makes their money will help you outsmart the bookmaker. By compare there odds to an exchange you will be able to see what odds they are offering that fairly reflect the market, or are somewhat out of ‘shape’

That should help you understand where the value betting opportunties are and how broad price changes in the market are likely to affect the exchange.