I’ve now been betting and Betfair trading for a living for over 20 years now, and I really can’t believe it. I mean, what a fantastic job I have, I basically get to watch sport for a living.

Much has changed over those twenty years but one thing hasn’t. That very thing led me to a revelation that catapulted my trading to a much higher level.

Betfair trading is born

So let me take you back to 20 years ago, there was a bit of history before I joined Betfair, but effectively I joined Betfair almost immediately they became open for business in June 2000.

Initially, I was arbing. I wasn’t trading, I would go to a bookmaker, place a bet with them and hedge that position on an exchange. But I woke up one morning and put two bets on the exchange, a lay bet and a back bet.

To my surprise, both those positions got matched and I had a profit. And I suddenly thought, hold on a second here, this is a completely new thing that I’m looking at here. At that point, I became very interested in doing this a bit more seriously.

So despite having a wife, three children, a mortgage, and a really good career I quit my job. When people said to me, what are you doing now, you can imagine the scepticism, I don’t need to describe that for you. And very few people were very supportive of it.

So one of the first lessons that I learned was, especially if you’re breaking new ground, you’re always going to have people that are sceptical and who don’t understand or see the vision. You shouldn’t let people put you off, just because you have seen something others haven’t.

Betfair trading software is born

During a talk that I did in London early in my Betfair trading career, I was contacted by somebody that was at that talk. He was a full-time coder, could see the same vision as me, so we started working together. Bet Angel was born.

But of course, as soon as you put a product in front of you, there’s a little bit of scepticism. I can understand that, especially in an industry like the betting and the trading industry. But for me it was a natural step. I was using lots of software on financial markets and wanted to do the same things in sports betting markets.

To give you some perspective, this was in an era before Betfair even had an API. Nobody had a product that would do what I wanted, so I created it!

I didn’t create the software to serve an existing market, as none existed. Creating Bet Angel was the thing that accelerated my trading and took me up another level. And of course, you’re always going to talk positively about that.

From there it’s evolved as the markets have evolved into a customer-driven product.

Trading order flow

When I started trading I already had sports pricing models and stuff that I could transplant straight into the exchange. But I wanted to expand into other markets.

One of the markets I wanted to target was horse racing. There was huge volume and I thought I have got to find a way to be able to actively trade on horse racing. So what I did was come up with the process and method of trading horse racing by looking at order flow and price action.

This was something that I’d seen done in financial markets. I thought I could do it on horse racing markets. And lo and behold, it worked.

Of course, this was a highly unusual way of betting so people were immediately sceptical and often still are. But it’s the most effective way of trading that I have discovered and the most enduring. This is because it relies on metrics that generally don’t change, one of them is human behaviour.

My greatest edge – How the penny finally dropped

About ten years into my journey I felt very comfortable with what I was doing. There were many things out of my control, but I was very comfortable with all the things in my control.

Well, apart from one thing.

I’ve done all of that work, carefully worked things out, quantified stuff, figured out what I was doing, why it was happening and things like this. But still, scepticism came. This used to annoy me, because you would be working enormous hours, getting up at three o’clock in the morning to trade and people just didn’t get it.

I figured out that what was happening was people would have a view on something, then they would start searching for evidence to support that view. But they would ignore stuff that didn’t fit that view.

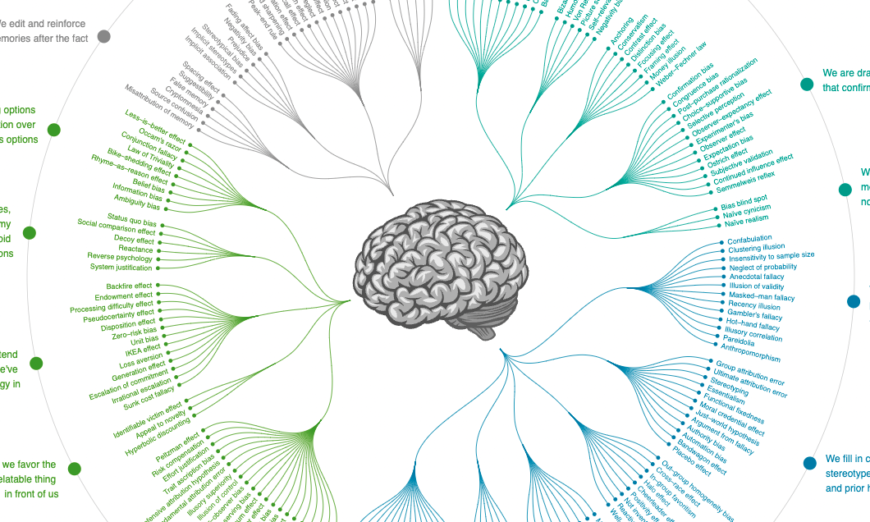

What I was actually looking at was a behavioural trait called confirmation bias.

I was thinking, well, that’s weird, because I’m sort of telling people exactly what the deal is, and you’re not getting it. Then every time I try and query that, then it just seemed to reinforce their views. You would get into these pointless circular arguments with no end. So I just sort of gave up arguing, there seemed no point.

I started to think well, there’s this bias, how would this bias manifest itself in the market? How would that play out and where am I likely to find that and can I quantify that to see that it exists.

How behavourial biases changed my trading

So in a weird sort of twist of fate, all that scepticism and its persistence actually presented me with one of the greatest opportunities that I could have ever discovered.

It allowed me to understand the flaws in the way people think. That led me to explore all the behavioural biases and led me to try and understand where those biases were likely to appear in the markets. Then I would understand and quantify it, and then go to exploit that within the market.

It completely changed the way I traded the markets. Rather than just exploiting the characteristics I started thinking through where the errors were likely to occur. I started to think about how people would think. That allowed me to anticipate where opportunities were likely to occur

Once I started doing that it was a revelation and very enlightening. Not only did it change the way I traded, but it changed the way I look at the world.

It’s a journey that I think everybody should take.