By now you have probably read part one and part two of my day trading journey, if not you can read them by clicking on the headlines left.

This is the story of how I quit my well-paid job, despite having a young family; to pursue my dream of doing something a bit special. Though I never figured at that exact moment it would, effectively, mean gambling on sport for a living. Betting on sports, professional gambling, any variant of those things, had been considered impossible and when I first started. I didn’t know if it was even possible.

Betting exchanges arrive on the scene

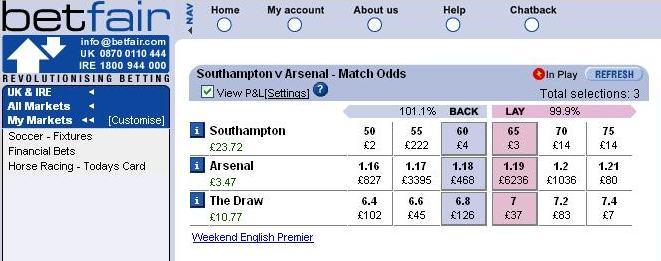

I placed my first bet on a betting exchange on June 5th 2000. It was a bet on the FTSE close market, which I won. It took until 11th June before I did my first sports bet, which was on Tiger Woods in the US Open Golf win market. Both these were on Flutter. Being a slacker, I didn’t join Betfair till the 18th of June 2000!

What I did first on a betting exchange

My approach was quite simple to start with. Because of my previous experience, I’d learned that there was likely to be money made by arbitraging. Betting exchanges gave me the opportunity to lay the first time ever, so I decided to try and find the best price I could find any bookmaker and lay a lower price on the exchange. Hey presto it worked, but only on a very small scale, but it was a fun way to participate while I was busy with a ‘normal’ job.

I continued to do this as often as I could and back then it was easy. Most bookmakers didn’t really have much of an online presence and bookmaker shops simply were unaware of betting exchanges. So I would scout for the best mismatch in prices and arbitrage between the two. Taken advantage of the fact I could back anywhere and lay off on the exchange at a nominated price. This was one of the massive advantages of betting exchanges. I didn’t need to worry about what price was on offer I would just put my order in the market at a lower price that I backed elsewhere and wait.

While this was arbitrage, it was massively different from what you see nowadays being heavily promoted as matched betting. Technical is very similar, looking at bookmaker offers or the odds that sportsbooks offer and using the exchange to offset the liability.

It was long before I started squeezing more margin out of the exchange by offering prices slightly outside the current price to gain a better edge. A few pennies here and there soon started to add up to a few pounds. But overall it was relatively small and insignificant, especially when compared to the job I was doing. I was negociating mult-million pound contracts on a regular basis. I had a three year old daughter as well. But I always had a passion for this sort of stuff so would insert a bit of it in-between what was an already manic lifestyle.

The day that Betfair trading was born

I can’t claim to be the first-ever person to have discovered Betfair trading, but I was probably amongst the first. I remember really clearly the moment the penny dropped.

One morning I woke up and realised that rather than scouting for the best back price I could find, I could actually place two bets on the betting exchange. If both of these prices got matched, that’s always been a big if, I would make money. I got the idea from financial markets. Betfair had sort of positioned themselves as a stock exchange for sports and with my knowledge of financial markets, that made sense.

One of the problems with financial markets was frictional costs, a killer when short term trading and direct market access. Back then the concept of direct market access, the ability to put orders in the market where you wish on either side, was extremely rare and reserved for the big boys. But betting exchanges effectively gave you that and you only paid commision if you won. It seemed too good to be true!

Why I was nervous when I first started trading on Betfair

Discovering trading was an epiphany, it felt like I’d discovered that one thing I was searching for all those years before. However, the idea was only that, an idea. As always, it wasn’t as straightforward as it first seemed.

When I first started doing it, it felt like I had discovered a possible quirk in the system and I feared it may be stopped soon after I discovered it. As I started pushing things a bit and the money started coming in, I feared the phone would ring one day and I’d be asked to stop. It also felt like I’d discovered something amazing and sharing that may destroy it.

Looking back that was a little irrational. But it’s very rare in your life will you actually ‘discover’ something. So I didn’t say much about it at first, I just got on and did it. As we know now it’s commonplace and, with Betfair’s cash out feature, this technique has actually become a unique selling point of betting exchanges and sportsbooks alike. It’s now part of the fabric of the betting landscape. The fact I’m still Betfair trading 20 years later, tells you I shouldn’t have feared any of that. Another lessson learn I guess.

Betfair trading and the very earliest markets

In the very early day’s liquidity was incredibly poor and therefore you couldn’t really do much, certainly not do it for a living! But over time liquidity started to improve and a virtuous cycle started up. More liquidity brought in more traditional punters seeking better prices to have a bet at. More punters meant more liquidity and you could take more risks when trading. Trading is really all about getting out of a duff position and minimising your losses. Liquidity allows you to do that.

Up to that point, I’d stayed with markets I was familiar with, which was generally football, golf and financial markets. But the thing that caught my eye was horse racing markets. There were so many races on all the time and the money in the market was enormous in comparison to other sports at the time. So I faced probably the biggest challenge ever which was to understand how to try and make money from horse racing. I had to learn about horse racing! In fact, it turned out that I managed to survive with very little knowledge of racing. I’ve got a bit better since then, but so have a few other things.

I was still at a formative stage at this point. I was also in my early 30s and for years harboured a strong desire to work for myself. But my normal career was still headed in the right direction and, over time, I had gradually progressed to more and more senior roles. I was travelling a lot, as I worked for international companies and I quite enjoyed that. So the dream of working for myself seemed further away than ever. But the desire was still there!

The next part of my story is the big bit… The leap into the unknown!

If my story is helping you and encouraging you to think about learning to trade. Download a free trial of Bet Angel and visit the Bet Angel Academy. Use my years of knowledge to give yourself a head start.