It seems difficult to imagine a time when it wasn’t ‘all about the in-play’ – but before Ray and Betfair there really wasn’t much concept of betting on an event after the official start time. How things have changed!

The start

Back when exchanges started, it was purely a replication of the traditional bookmaker regime. Similar sports and similar punting styles, but exchanges brought this new concept of betting while an even was underway.

In essence, some markets were ‘in-play’ already on Betfair from day one. I did a lot on financial markets when I first started on Betfair and the FTSE up/down market would run every hour till the hour for settlement purposes. Financial markets were ‘in-play’ between 9am and 4:30pm. But betting on a horse race while it was running seemed madness.

Growth

Back in 2005 things were growing rapidly from a small base. Racing grew more and more popular, football was an obvious market for trading in and out of positions as the match progressed. Football was the first in-running market I modelled, as I had successfully done that in the distant past, but I didn’t really look much beyond that initially. Football and Racing were big markets, but Racing always seemed to be ‘stuck’ at 20% of the total turnover. With racing volumes in general accelerating, then levelling off. That 20% of turnover meant that, in relative terms, racing started to fall behind Football.

Changing places

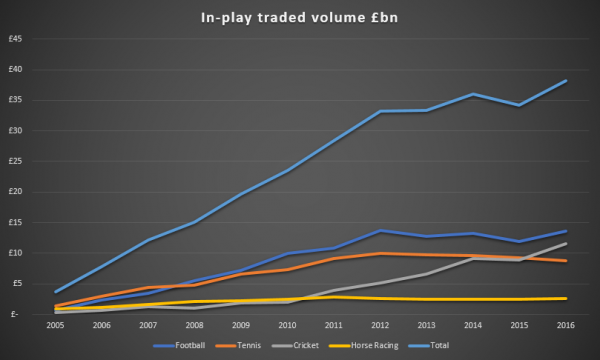

Tennis quickly overtook Football as the sport of choice for in-play traders and it quickly accelerated upwards. If we re-visit the top line of all in-play matched bets, we see that from a total of under £5bn matched in 2005 we saw pretty much straight line growth mid-2011. Premium charge payers may hint that the shallow nature of the growth since then is an indication of lost business for Betfair. However, the growth has continued, albeit a little slower. But from 2005 to 2016 we have gone from £5bn to £40bn a year matched in-play. I suspect that adding in sportsbook figures which don’t show here, would probably boost the numbers a bit. It’s difficult to tell as actual numbers were once discussed openly, but are now hidden in a mixture of other, generic, financial reporting numbers.

The future

Both Tennis and Football have been in relative decline since 2012. By relative, I mean they are smaller as a proportion to the total number. But a new star has emerged from the mix, Cricket. I don’t trade cricket much as I’m too busy on the big three sports, but with a little more growth Cricket could well turn into THE biggest in-play sport in the next year.

If we look back at 2011, £4bn was matched on Cricket alone, last year this had shot up to £11.6bn. Football had risen from £10.8bn to £13.6bn and all other major sports had declined. You can see from the chart however that the football number is a little deceptive as it’s more or less flatlined in recent years. Again, we can’t see positions that are accepted by Betfair but not hedged on the exchange.

Overall

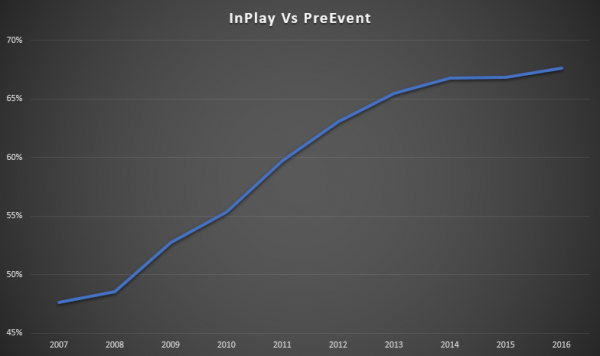

Seeing all this growth I was curious as to how in-play compared to pre-off volumes on the exchange. It’s a really interesting story, as it appears that overall in-play is getting more and more business on the exchange. Back in 2007 less than 50% of total exchange turnover was in-play but that has been increasing steadily over the years. In 2016, 68% of all exchange turnover was in-play.

This more or less makes sense. Bookmakers can target exchanges with attractive opening account offers, but accurately pricing a market with margin in-play is a little harder. So it seems that people looking to get a decent price or hedge a position, are most likely to look to an exchange. It’s possible that Betfair picking off the low hanging mug punters with the sports book has also changed the mix a little. But the graph makes interesting viewing.

But the overall summary of the current situation is that in-play is still growing fast and especially so in Cricket.