Just an ordinary day

Back in 2018, I recorded what an average day of trading was like and I wanted to go into more detail within this blog post.

Let me set the scene for you, it was a Monday after Cheltenham and I did some horse race trading in the sort of the manner in which I would expect. I didn’t go massively aggressive and I went a bit cautious as I was filming a video (which I’ve linked above) about my daily trading. This was also a Monday, the lowest day of the week at ta weak time of the year.

I felt this would be a example as it wasn’t a stand out day and would show what your key objective is when Betfair trading pre-off on Horse racing. It’s easy to get excited by some of the massive totals I pull in at major festivals, but the day to day stuff is less exciting, but a good example of what your true objective it.

There are tons of these sorts of days on the racing card over the course of a year, but fewer big race. So how did it go…? It went okay actually!

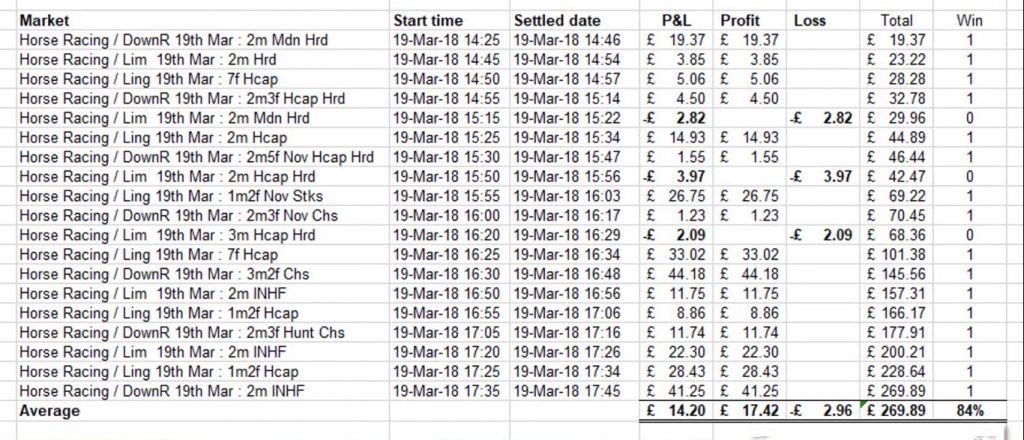

Results : Trading pre-race on Betfair horse racing markets

So I fired up Bet Angel and I traded 19 races overall, I lost on 3 of those. I was able to contain the losses on those two quite tight numbers. I did okay on all of the rest of the races from 16 to 19. This resulted in a strike rate of about 85%.

Now, as I’ve said in the past, I’m quite likely to get a strike rate where on 7 or 8 out of 10 races I’m able to lock in a profit and I’ll lose on the others. That’s sort of the natural progression that I’ve seen over a long number of years. I go into each day expecting to lose 20-30% of trades.

So the strike rate, the rate at which I have a winning trade, was about what I expected. It was probably slightly higher than I would have expected. I would have imagined that out of 20 races maybe to lose 4 to 5 races. The fact is that I actually managed to do a little bit better on that front.

Winning long term is about a balance of profits and losses

If you look at the average amount of money won in the image above, you can see that I’ve won, on average, a reasonable amount. The average win per race was around £14.

My average loss was absolutely tiny and that’s typically not that unusual for me, I try hard to limit losses and expect profits to occur. Although I have to say, that when I was doing it I knew that I was going to post a video about it so it’s probably a little bit more cautious than I would typically trade!

When I’m at a big meeting, it’s all about throwing as much money at the market as I possible can in a measure and safe manner. When I am in these ‘normal’ markets, then I tend to be a little bit more defensive. As I knew I was going to record a video on it and I was going to publish the results I was extra defensive, so I probably could have maybe made a bit more money if I would’ve traded it more aggressively.

I was just trying to go for a nice, neat result. It’s funny because even I suffer from performance anxiety and everybody suffers from performance anxiety, especially England footballers when they’re about to take a penalty.

I was still able to trade fairly effectively, but maybe I could’ve probably pushed a little bit harder… However, even if I would have gotten bigger results it would also most likely result in a few more losses as well. But as the day progressed, I just kept things neat and tidy and it is my bad for not pushing as hard as possible!

Hopefully, this will give you an illustration as to the sort of what you expect to see on everyday.

What would I expect from ‘normal’ markets…

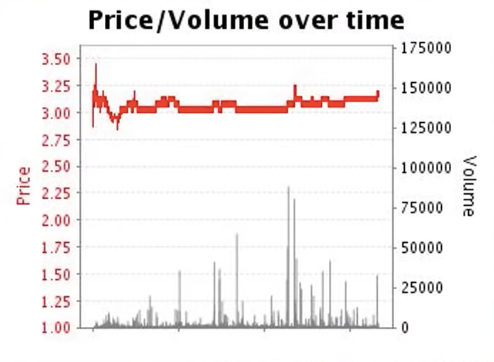

Where there is volume, liquidity can also appear and when you get a nice combination of these two I can really produce some spectacular results. However, more normal markets are much less exciting and trade in a different manner.

From the day to day to racing markets I would expect: –

A) More losses.

B) For them to be slightly bigger.

However, on this particular day, I was reading the market pretty well. I slotted into the zone fairly quickly and was able to find reasonable entry points in most of the markets. This is what accounts for the lack of losses and also the size of them, which is very small.

Typically, that’s not normally the case and I’m guessing I was influenced by what I wanted the outcome to be. But it panned out pretty much the way that I expected and laid out in a past video on ‘My strategy for trading ‘normal’ horse racing markets.’ (https://bit.ly/36Oe6wn)

What do you need to look for when trading in any market?

Generally what you’re looking at when you’re looking for long term profitable trading is 3 different things.

- You’re looking at a strike rate.

- You’re looking at how much you win

- Finally, you’re looking at how much you lose.

You may be thinking, well, isn’t that like just one trade? Typically not, because if your strike rate is very high, then it’s possible that when you actually win, you can win much less than you lose.

I know that sounds a little bit odd, but it’s true. Basically, the higher your strike rate is, then you don’t have to go for as much profit and when you get losses, they can be a little bit bigger as well.

If your strike rate comes all the way down, then that equation changes significantly. So typically, the perfect scenario would be a very high strike rate. When you win, you win decent amounts and when you lose, you lose almost nothing. This is what I managed to achieve on this usual day, but that’s not the norm. The norm is a balance between all of those three things.

Why keeping records is important

When I’m looking at record-keeping that’s what I tend to monitor and keep checking back when I’m looking at. I make a note of these key metrics: –

How often do I win? How much do I win? Then that itself will actually tell me how much I can afford to lose… Of course, I measure losses as well, but one part of that trading equation will set your objective for the other.

That’s pretty much where I started trading from. I would go into the market and actively trade it to figure out what my general loss was. Then I would think, if I’m losing this much, then I need to win this much on average and my strike rate has to be around here.

Understanding your Strike Rate and Betfair Scalping

Strike Rate – the percentage of trades that you win against the percentage that you lose.

– Definition of strike rate

Scalping is a trading style that specialises in profiting off small price changes, generally after a trade is executed and becomes profitable.

– Definition of scalping in trading

When I’m talking about strike rate, it’s predominantly defined by how good you are at picking positions within the market. However, you’ll be surprised because some of it is dependent upon the level of trade. So if I go in and I scalp a market, for example, I’ll get a very high strike rate and that’s because when you look at how we see the market trading, it basically moves in small, bumpy lines.

Therefore, if you put two orders in, you’re going to get both of them filled reasonably quickly and you will get them filled with a high strike rate. It doesn’t matter if you start with a back or lay bet, they will fill very often if you put them only one tick apart. Prices move up and down a bit and take both prices out.

For example, if you go for a move that’s less than 5 ticks then your strike rate should be generally high. That is unless you exit the trade very quickly, because then what happens is then you negate your long term profit immediately by lowering the strike rate, cutting out the position too quickly before it’s matured for a profit.

So if you are scalping and going for a one tick profit and a small price movement you’ll probably get that quite frequently. But if you’re going for a larger move, then the larger the move you go for, your strike rate will fall.

However, the amount of profit you get from that move will be quite high. So it will offset losses that you make when you get that wrong.

So typically, if you’re scalping, you want to put a trade in the market, while you have a very high strike rate, but you’re limiting your potential profits to one. So that effectively frames the amount of profit that you can afford to lose. So scalping becomes entirely strike rate dependent.

However, if you’re doing a large trend or a swing trade, then what you’ll typically find is that you’re going to have a very large move and your strike rate could be a little bit lower. But when you get into one of those trades and you realise that it’s a mistake, if you dump that position reasonably quickly, then your strike rate will go down.

Remember, when you catch those big moves, as long as you’re getting into the market at a moment when there’s big moves are likely to occur, then that will more than offset your lower strike rate and the more frequent losses that you’re getting.

This is a strategy you would necessarily apply if you’re trying to catch a large movement within the market.

There’s a saying in the stock market which is to “cut your losses and their profits run.”

A strike rate can be defined by how much money you’re asking for. If you’re asking for one tick, a straight rate is going to be high. It should be high because if it’s not high enough, you’re not going to make money over the long term.

However, when you’re looking over a much bigger move, you can afford for a strike rate to be a little bit lower. But for your losses are going to dwarf the amount of times that you get it wrong because you go into the market and you realise you made a mistake, dumping it, trying again and then eventually the move occurs.

Successful trading is all about the combination of all those things.

Analysing your trading

So when I am approaching any market I go into the betting exchange that I’m using and I’ll download a spreadsheet of all of my activity over that particular day. I’ll then arrange that spreadsheet in such a manner that it shows how often I won, how much I won, when I did win and how much I lost when I eventually lost. You can see I have done this on this occasion.

This gives you an idea about how you’re operating within the market. If any of those numbers are out of kilter, you know what you must address.

If your losses are too big and probably you’re not getting into the market at the right time or you’re letting those losses run for too long. If your losses are small and your strike rates are reasonable, but you’re not really making much, then you probably need to let those trades run a little bit further.

So it’s the interaction between strike rate and the win and loss value that defines whether you trading successfully or not.

If you don’t keep any notes, then you’ll never know what’s generally going wrong. Is your strike only 30% or is it 70%? How much are you winning in proportion to how much are you losing? That will guide you in terms of what you need to adjust in your particular trading.

An under-rated trading skill

With my example trading day, I traded 19 races. I skipped a few of them because that was the easiest way to avoid a loss. I just looked at them and I just couldn’t see an opportunity, so I didn’t trade them. This is an underrated trading skill.

Skipping races can be for any reason, you could be in a market that you recognise, but nothing happens or you could just look at the market and say, well, I don’t know what’s happening and therefore the best thing to do is to avoid it. Too many people get involved in a trade simply because they want to make some money and they don’t think through whether there is an opportunity to do something there or not.

Trading non-feature meetings – Summary

So all the above is typically what I’ll sort of be doing around the weaker parts of the card and the weaker parts of the week at certain times of the year. As the quality improves, then I get a little bit more aggressive and those numbers begin to rise. So I’d summarise by saying, I trade fairly defensively outside of major horse racing meetings.

In general, I’ll lower or increase my stake according to what I expect to see, how I expect to trade and exactly what I’m trading. You can see that in comparison by looking at the results I can post in a major meeting and then how everything drops down as we move back into more normal racing.

The simple fact is, that P&L from my example trading on an average day of trading on a Monday, is what’s going to make up 80% of the year and the remaining 20% will be much bigger opportunities at bigger events, on bigger days, at bigger races and so on. While these days are small, there are more of them over the year.

I hope that that’s given you an insight as to how you’re likely to trade and what you’re likely to see, and how trading an average meeting is different from a major meeting. Failing to adjust your trading style between meetings will mean that you can’t manage your risk effectively.

This should also show you how important it is to monitor your trading stats. Doing that will allow you to trade and adjust to different trading markets effectively, allowing you to achieve long term profitability.

Hi Peter,

Love your videos always very clear.

Could you please help or advise me where to learn how to trade the pre horse racing markets.

Thanks

All the information you need is on this blog and at the Academy – http://www.betangelacademy.com

Thanks Peter,

You dont recommend buying a course such as Betfair Scalper?

I will re watch the Bet angel academy videos also.

Thank you