The biggest ever win that I’ve had in one day was just short of £30,000.

However, how you measure your overall result is very dependent upon whether you’re betting or trading and people often get the two mixed up.

So in this blog post, I’m going to explore what the key difference is when betting versus trading.

Are you betting or are you trading?

When I asked the simple question of are you betting or are you trading, it seems like a really easy answer to give because you’re either betting or trading. Surely there must be a sort of fairly familiar line between the two. However, I often see a lot of strategies out there that are sort of positioned as trading when they’re really betting.

It’s really important that you understand the differences between the two as they both carry different levels of risks and the payoffs are slightly different. So there are a number of things that you need to be aware of if you’re going to be successful at both of them.

The biggest ever payday that I had with any strategy at all was just short of £30,000 in one day. However, I didn’t look at it like that because £30,000 in one day sounds mighty impressive, but this was predominantly a betting strategy. One that performed really well on this day, but on other days it probably wouldn’t and that’s key.

So what are the differences?

When you’re placing a bet, whether it’s a back bet or a lay bet, you will profit on that in the long term by winning slightly more than you lose. When you’re actively trading, it’s not like that at all.

When you’re actively trading a market, you have a stake you are using, but the potential return will be a small percentage of that.

The entire state should never be at risk at any point within your trade and this is one of the key elements of trading. So you might be using large amounts of money, but you’re only actually trading the small amount of movement that you get within the market or a window within that market.

There should never be a situation where you put that large stake at risk beyond that. A common mistake is when they trade racing pre-off, for example, they are looking at a large stake even though the average traded range is quite small that they’re actively trading. This then doesn’t go particularly well and they end up with that entire stake in play.

Of course, they then lose that entire stake and it takes a lot of effort to be able to recover that overall stake when you’re actively trading. So the simple thing to do is just put another bet on the next race, which then loses and all of a sudden everything has gone horribly wrong!

It is really important that you differentiate between a bet and a trade because the stake levels that you use and the returns that you get on those stakes are completely different.

Did I actually win £30,000?

So while my best ever day yielded a return of nearly £30,000, I didn’t see it as a return of £30,000, I actually saw it as a percentage of that. That was because when you’ve been in the market for as long as I have, you’re going to catch the odd outlier and this particular day was an outlier.

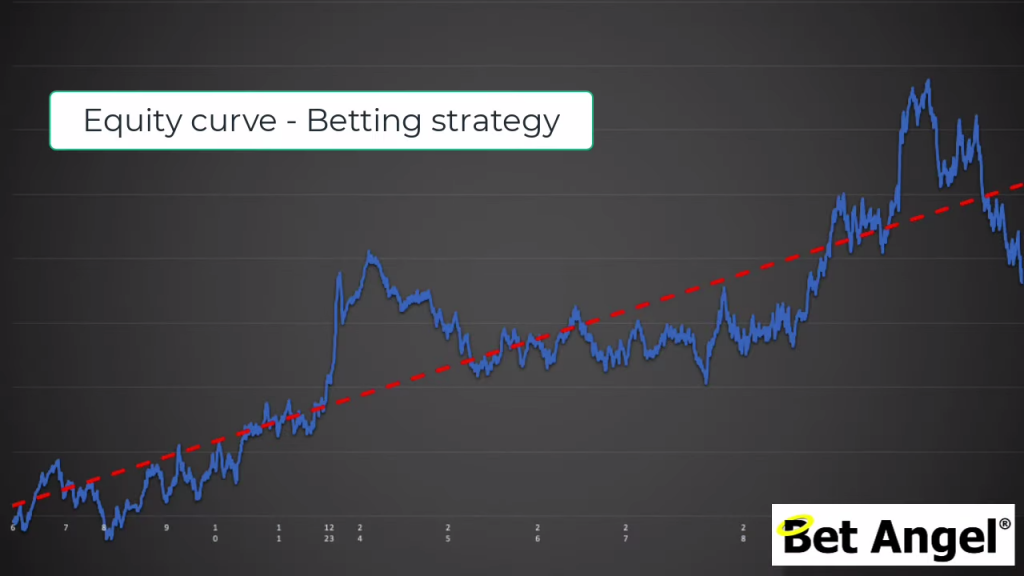

With a betting strategy, you sort of win three grand one day, lose two the next, win five, lose three and a half etc. It’s an unusual pattern of activity, but you get steep up curves and big draw downs and generally, that’s exactly what’s happens!

You can see above what this should typically look like, it rises and falls all over the place. You see if you look at the equity curve on the trading strategy, you can say it’s just a nice, gentle upward slope. That is because when you’re betting the result you have is outcome dependent.

Treat your success as a long term edge

So that £30,000 that I won, it just happened on a day I got every single one right, which is really rare!

So I never saw that as £30,000, I knew what my long term edge was. Now let’s say that my long term edge was 5% on average per bet that I put into the market. Then you would really see that £30,000 as about £1500. You need to remind yourself, his is my long term edge and that’s a percentage of the amount that I’ve won, therefore, that’s really what I achieved on that day.

However, when I’m trading, it’s not uncommon for me to get into four figures on any one day. The difference with trading is that it’s pure profit and that is because it’s not outcome dependent.

What do we mean by that? Well, when we’re actively trading horse racing, we will trade a certain amount and at the end of that particular period of trading, which is typically pre-off, we hedge our position. Now the result becomes outcome independent and that’s one of the big differentiators.

The stake is bigger when you’re betting, the returns that you get a bigger the P&L is more variable, but also its results dependent. When you’re trading, you’re using a large stake, but you’re only trading the volatility of a small part of that. Effectively, what you’re doing is you’re trading the profit on the bet.

Even though your return will always be slightly smaller, but at the end of that sequence of events, you are actually hedging your profit or loss. That is a true P&L that drops straight to your bottom line and you win or you lose at that particular moment in time.

It’s outcome independent, it doesn’t matter who wins or what happens – that is your money to bank

Betting strategies disguised as trading strategies

So there’s a big difference between the two of them. As trading has become popularised, you often see people positioning betting strategies as trading, but they’re not. As I’ve said, you’ve got these key differences between the two and to call a betting strategy a trading strategy is completely false because you’re looking at entirely different things.

If we are betting in the last 10 minutes of a football match, for example, say we’re looking for goal in that final 10 minutes. The price is 1.5 and I think there’s going to be goal in the last ten minutes if you put that position in the market and then you wait to the end of the match, that’s effectively a bet.

You’re doing a value bet, because you’re not going to win every time. It’s not outcome independent and therefore, whatever steak you put down you’ll only ever win over the long term, a small percentage of that. This is definitely a betting strategy.

However, if you said I’m going to back under two and a half goal, I’m going to wait until 15 minutes, if there’s a goal, this is what I’m going to do and if there’s no goal, that’s what I’m going to do. Then you’ve got a trading strategy because what you’re doing is you’re framing an opportunity and you’re creating an outcome independent result at the end of that process. You then can decide what to do from that particular point.

Also you can repeat it as well. So in tennis, for example, a player has a set down on a breakdown and you say, I’m going to take a position on this on the basis that he will get a break back before the set etc.

Here you’ve developed a trading plan where you’ve got:

- a defined entry

- a defined exit

Where your position will be hedged for a profit or a loss to become outcome independent – that’s a trade!

If you’re betting on something on the basis the price is out of kilter and your return comes back to you over the course of a thousand bets and it’s represented as a percentage of that, you’re then taking outright risk and and so on. This means you’ve got a bet and that’s a different strategy.

Don’t treat them as the same

You can’t really merge the two. They’re not really compatible with each other because the return on stakes and the outcome are very different from the two of them.

I do use both, but I run them on different accounts so that I’ve got an objective measure of exactly what’s going on and how well I’m doing. I never merge the two strategies together, I see them as completely independent and separate.

You also got another benefit with trading as well, because this is what freaks people out about trading as typically they see those large stake numbers and they feel like that is at risk.

How to view your risk in the market

However, if you’re trading honestly and truly that large stake is never at risk, but you’re only ever trading a small section. I started with very small stakes when I was trading and you get very small returns as a consequence! But I just gradually increase the size of my bank over time and got more and more comfortable, so I can put substantial amounts through the market now.

One of the big benefits of trading is, say you’ve got an active trade and you’re actively trading that market and you’ve done it successfully. We make a small profit or loss by the amount of money in the window of opportunity that we have created.

Now think about it, your trade doesn’t have to stop there… You can repeat the trade!

When you place a bet your bet comes down and you have to wait for the outcome of the result and sure enough, you can do many different events, but when you’re actively trading, you can repeat the trade. So this is another characteristic that you see within a trading market that makes it quite beneficial, but also changes the way that you view your risk within the market and exactly what you’re doing.

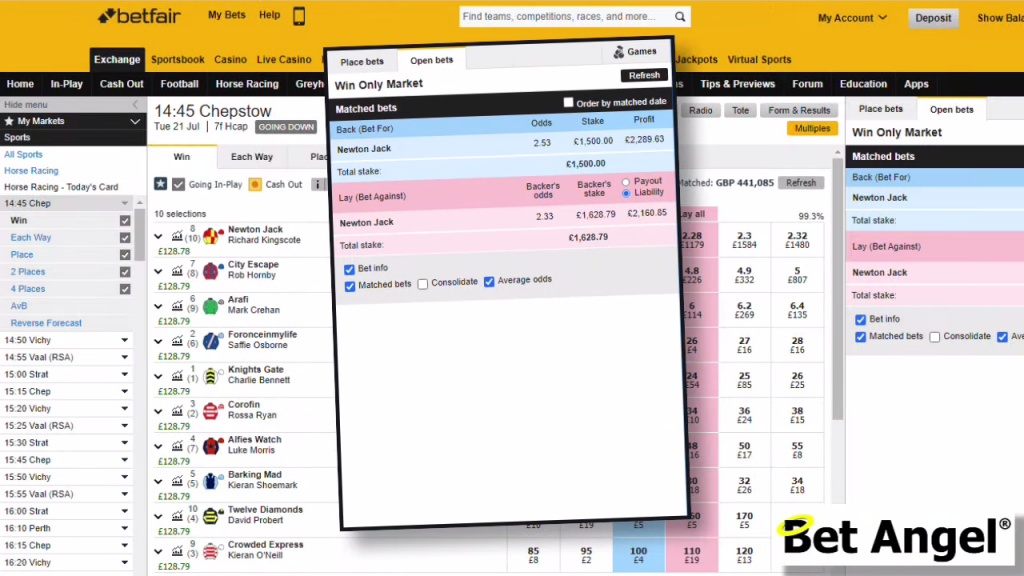

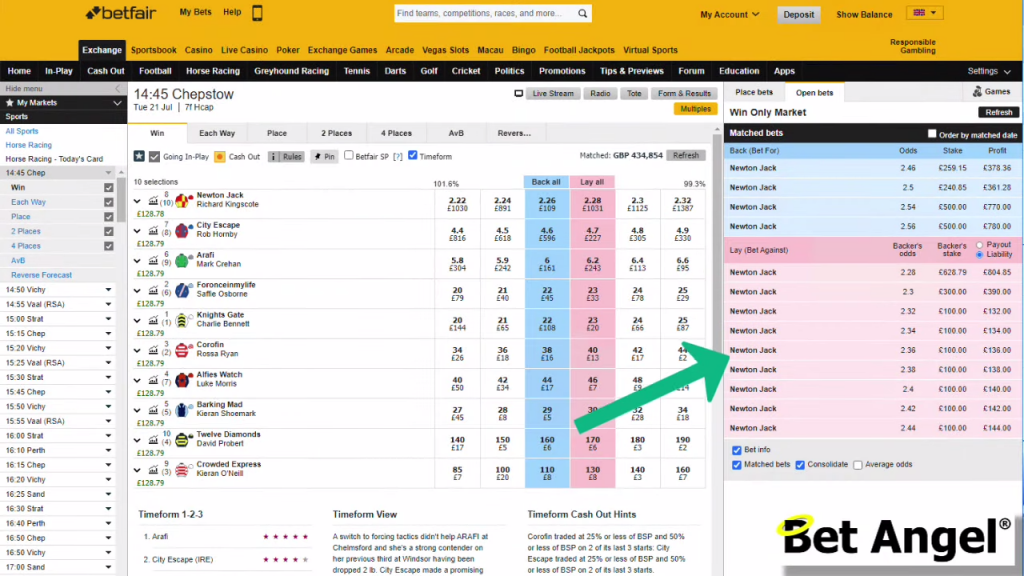

So there was a trade I’ve done in the past that when you actually look at the amount that I put through the market it could possibly freak you out because it looks like I’ve risked a huge amount of money for a relatively small level of return

However, on this particular trade, what I did was I entered the market several times. So in fact, the stake I was using was quite small, but I did the trade multiple times.

This is another characteristic when you’re looking at an active trading market.

What you need to understand about winning £30,000 in one day

Firstly, you need to remember there is a big differentiation between betting and trading. You need to make sure that you understand whether you’re actively betting, whether you’re taking an outright risk or whether you’re truly trading, which is looking for a window of opportunity, defining it and making it result independent.

Whichever one of those you do, you need to understand what that is, because it directly affects the way that you stake, the way that you interpret results and the way that you go forward.

I spend most of my time actively trading because I know that that is money that drops straight into my account at the end of that process. When you’re betting or trading your P&L’s are much more variable so have to may have to wait for a very long period of time before you know if you have a true edge.

I hope this separated for you the two ways to make money in the sports market and it has given you a clear idea of what your true objective is when you’re betting or trading.